AABC2025 wrap-up: Start-ups, a 360-year-old oldie and an elephant in the room!

Management Summary

Over 100 companies took part in this year’s Advanced Automotive Battery Conference Europe (#AABC2025). Below we present six companies that particularly caught our attention in presentations, during tours of the trade fair or in conversation with other conference visitors.

They include four start-ups, an oldie with over 360 years of company history and a Swedish company that was not even present at the conference, but was somehow always there as the “elephant in the room”:

- Saint-Gobain has been one of the world’s leading glass producers since it was founded in 1665. The company has now arrived in the e-mobility age and is developing composite materials for the thermal and mechanical encapsulation of Li-Io cells.

- 24M has developed a new type of separator film designed to offer increased protection against short circuits within the cell.

- Anaphite has developed an innovative material for the dry coating of electrodes.

- HCM is a Taiwanese start-up and produces powder for LMFP cells.

- Battery Dynamics is a German start-up from Munich and develops high-precision measuring devices for Li-Io cells.

- Northvolt was the “elephant in the room” at #AABC2025. Launched as the beacon of hope for European cell production, the company has since had to file for insolvency. We spoke to many experts at the #AABC2025 about the potential causes of its failure.

Saint-Gobain

Saint-Gobain’s company history began in the 17th century and is closely linked to the French King Louis the 14th and the Palace of Versailles. The large Hall of Mirrors required a large number of mirrors, which at the time could only be produced in Venice.

As the mirrors from Venice were very expensive, King Louis decided to set up his own glass production in France. Incidentally, transporting the mirrors was also very expensive, as they had to be stored in butter to prevent damage during transportation.

In order to break the Venetian monopoly, Italian glassmakers were enticed away to France to set up their own production facility for glass and mirrors. This was set up in the town of Saint-Gobain, north-west of Paris.

Composite materials from Saint-Gobain for the protection of Li-Io batteries, photo booth #AABC2025

(Mit freundlicher Genehmigung/Courtesy of ev-portal.net)

Today, the company of the same name is a global industrial group specializing in the development, manufacture and marketing of high-tech materials for a wide range of applications. It is active in over 70 countries and employs more than 160,000 people. Sain-Gobain’s special skill lies in its ability to produce a wide variety of materials itself and combine them into composite materials, such as ceramics and plastics.

Based on this know-how, the company manufactures high-performance materials such as special glasses, sealing and insulating materials and ceramic components for thermal and mechanical management in e-mobility and battery technology.

The products include thermally conductive gap pads, flame-retardant foams, cell-to-cell seals and thermal runaway barrier layers, which are used in battery modules and packs for the Mercedes EQS, for example.

24M

24M is a US start-up for cell production technologies that was founded in 2015 by former MIT researchers and currently has 200 employees.

24M markets a production technology in which the electrodes of Li-Io cells are integrated directly into the battery pack. The business model is based on licensing the production process; licensees include the Japanese tech group Kyocera, the VW subsidiary PowerCo, Fujifilm and the cell start-up Freyr.

You can find a more detailed company portrait of 24M here.

Seperatorfolie von 24M, Foto Messestand #AABC2025

(Mit freundlicher Genehmigung/Courtesy of ev-portal.net)

At the #AABC2025, 24M presented a new product designed to increase the safety of Li-Io batteries.

It is a separator film that offers improved protection in the event of a short circuit within a Li-Io cell. This is caused by so-called dendrites, i.e. needle-like lithium deposits that can form on the anode during charging. Over time, these can puncture the separator, which can lead to short circuits, loss of capacity and even fires.

Dendrite formation is a key safety risk for lithium-ion batteries. The innovative separator from 24M sends an electrical signal to the Battery Management System (BMS) if there is a short circuit. The BMS is thus able to deactivate the cell in a targeted manner to prevent further damage.

The film is marketed under the name Impervio Separator, and a sample was exhibited at the #AABC2025 trade fair stand (see image). Sales are scheduled to start in 2026.

Anaphite

Anaphite is a start-up from Bristol that has developed an innovative production process for lithium-ion cells. The company was founded in 2018 by Alex Hewitt and Sam Burrow as a spin-out from the University of Bristol.

The technology combines active material, conductive additives and binders in a single, ready-to-use powder. To understand Anaphite’s innovation, you need to know how the production of lithium-ion cells works.

In the first production step, the electrodes are manufactured, i.e. the anode and the cathode. For this purpose, a viscous paste, known as slurry, is applied to a carrier film, which is then dried in ovens.

This drying phase takes several days and requires a lot of energy, which is why alternative coating processes have been researched for many years. One approach is so-called dry coating, in which the electrode material is applied to the carrier film as a dry powder.

The problem here is the degree of mixing or the consistency of the solid powder, which is generally poorer than that of the liquid slurry.

Calendering of DCP® powder

(Mit freundlicher Genehmigung/Courtesy of Anaphite [Homepage])

This is where Anaphite’s process comes in: The start-up has developed a method with which the electrode materials are combined together in liquid form to achieve excellent dispersion and produce a well-structured powder. The highlight is that the liquid is removed in a low energy process to produce the dry powder, which can then be calendered directly onto the current collector.

The so-called DCP® powder (Dry Coating Precursor) can be processed without solvents and energy-intensive drying ovens and is said to reduce energy consumption by up to 30%. It reduces production costs by around 40 % and saves space in cell production.

In 2024, the company raised USD 13.7 million in a Series A financing round to scale up its pilot production and further expand initial partnerships with battery manufacturers and automotive OEMs.

The goal is industrialization and market launch from 2028.

HCM

The Taiwanese start-up HCM was founded in 1997 and is now the world’s largest manufacturer of LMFP powder, according to its own information. This material is required for Li-Io cells with LMPF cell chemistry for the production of the cathode.

LMFP stands for lithium manganese iron phosphate and is a further development of LFP chemistry, i.e. lithium iron phosphate.

Cells with LFP chemistry have made a real triumphal march in recent years; they have been massively pushed in recent years, especially in China by BYD and CATL. Many vehicle manufacturers in the USA and Europe have also announced BEV models with LFP technology for the entry-level segment.

In contrast to NMC cells, cells with LFP chemistry do not require critical raw materials such as nickel and cobalt, have better cyclicity and are more robust against overheating.

The disadvantage is the low energy density of a maximum of 160 Wh/kg.

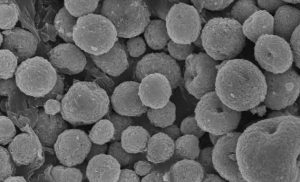

LMFP powder of HCM

(Mit freundlicher Genehmigung/Courtesy of HCM [Homepage])

This is where HCM’s business idea comes in: By adding manganese, the energy density of LFP cells can be increased to 210 Wh/kg while retaining all the advantages of LFP.

The first production line was launched in 2016 and a production line for mass production has been in operation since 2024. HCM is now looking for cell manufacturers who would like to get involved in LMPF cell production.

The company sees fields of application in the automotive sector (BEV, PHEV), aviation (eVTOL) and stationary storage systems (ESS). HCM produces its own cells in small batches in pouch format to test the technology.

Battery Dynamics

The German start-up Battery Dynamics was founded in Munich in 2018 by Peter Keil, who was awarded the Bavarian Energy Prize 2020 by Bavarian Energy Minister Hubert Aiwanger in 2020.

The company produces high-precision measuring devices that can be used to monitor the voltage and current of Li-Io cells during charging and discharging processes.

As a service provider, the start-up carries out series of measurements to determine the performance and ageing of Li-Io cells on behalf of cell manufacturers or users such as OEMs. It goes without saying that the company’s own technology is used.

L-Series measuring device from Battery Dynamics

(Mit freundlicher Genehmigung/Courtesy of Battery Dynamics [Homepage])

There are currently three product lines in the S (small), M (medium) and L (large) series, which cover a wide range of applications. All devices are designed as 19-inch racks. The L series is designed for large cells with currents of up to 200 A; cells with this format are mainly used in the automotive industry (see illustration).

Mr. Keil himself was present on the stand at #AABC2025. In conversation, he explained to me that he can use his measurement technology to determine the control quality of climate chambers.

To understand his comment, one should know that cell measurement is usually carried out under precisely defined ambient conditions (temperature, humidity) in climate chambers. These devices are equipped with controllers, whereby minor temperature fluctuations cannot be ruled out (e.g. oscillation of the controller).

Mr. Keil told me with a certain smile that even the smallest temperature deviations can be detected with his high-precision measuring devices.

Northvolt

The Swedish start-up Northvolt was one of the great hopes for an independent European Li-ion cell production. For many experts, its insolvency at the beginning of 2025 came as a shock, as the company had had a perfect start-up phase:

- Northvolt was founded by former Tesla managers Peter Carlsson and Paolo Cerruti, so the top management definitely had experience in the field of electromobility.

- Well-known car manufacturers such as BMW, Scania and VW were very quickly available as investors and customers for Li-Io cells. The prerequisites for setting up successful cell production were therefore in place.

Nevertheless, Northvolt was unable to establish a performing cell production. BMW was one of the first OEMs to stop working with the Swedish start-up in 2024, with other OEMs following suit.

We spoke to many battery experts at #AABC2025 about the possible reasons for the failure, the most frequently suspected causes being:

As a newcomer, Northvolt underestimated the time and complexity of cell production.

The production of Li-Io cells is complex and consists of many different steps in which production technologies from very different domains (chemistry, coating, mechanics, robotics, etc.) must be mastered. The large number of production parameters creates a huge search space, and adjusting the parameters by means of trial and error is extremely time-consuming.

Northvolt ramped up production too quickly.

When setting up cell production, you should start with a small series (< 2GWh). If this is stable, you can build up a medium series production (< 5GWH) and only then a large series (> 5GWh). Nothvolt wanted to get into large-scale production as quickly as possible, which never ran stably.

Northvolt has not focused enough.

The variance of the product “Li-Io cell” is very high. There are three different designs (pouch, cell, prismatic), and the size can also vary in each design. Each design can be produced with many different cell chemistry variants (e.g. NMC, LFP), each cell chemistry variant has its own subtypes (e.g. NMC111, NMC811). From the beginning, Nortvolt wanted to produce different cells for cars, trucks and stationary storage systems, but in the end no market could be served.

Northvolt wanted to do too much itself.

A good make-buy strategy is an important success factor. When setting up a cell production facility, you should initially rely on good suppliers who can deliver the preliminary products in good quality. Northvolt wanted to do everything itself, from the extraction of raw materials to cell production, and was therefore completely overwhelmed.

It is to be hoped that the remaining large-scale producers such as ACC, PowerCo and Verkor will learn from Northvolt’s mistakes, as European cell production is absolutely essential for geostrategic reasons alone.

The focus on one cell type (prismatic) and one cell size (VW unified cell) at PowerCo seems to be a first step in the right direction.