Reaction of the Established

VW ID.7

(Mit freundlicher Genehmigung/Courtesy of Volkswagen AG [News])

Management Summary

It is the perfect storm: the world’s largest, established vehicle manufacturers are being hit by the disruption triggered by electromobility at a time when they have already been massively shaken by the coronavirus pandemic.

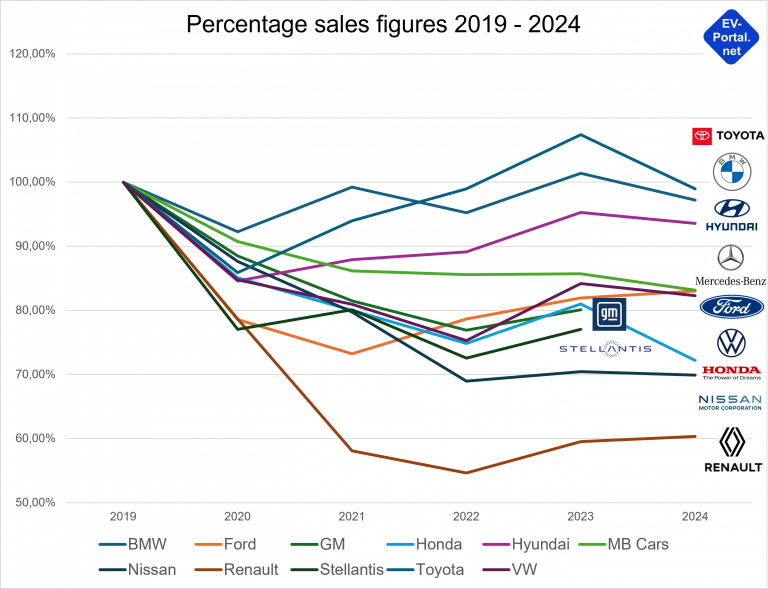

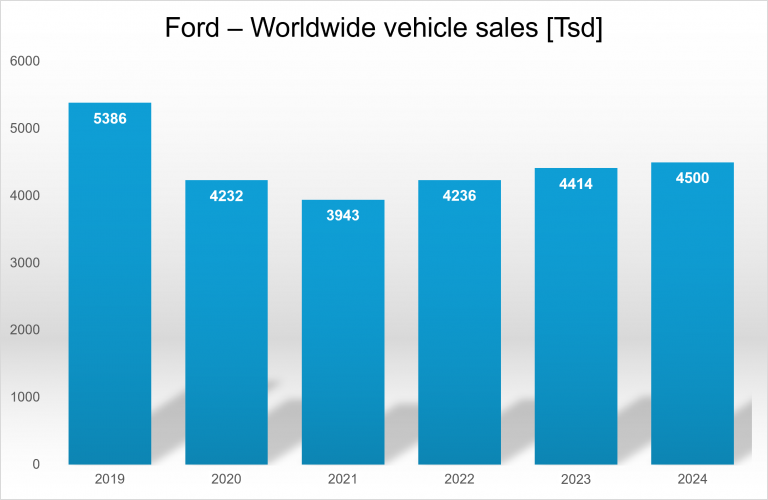

The chart above illustrates the situation: all major vehicle manufacturers suffered a significant drop in sales after 2019 (Chinese manufacturers are not considered here).

Only three OEMs – Toyota, BMW and Hyundai – were able to come close to their 2019 sales figures again. Sales figures for all other car manufacturers have leveled off at a significantly lower level:

- Mercedes–Benz, Ford, VW, GM and Stellantis are in the range of 80% of pre-corona sales.

- Honda and Nissan are even more affected at around 70%.

- Renault brings up the rear with 60%; the French car manufacturer is also suffering from the separation from its Russian subsidiary Avtovazm.

Despite the coronavirus pandemic, established vehicle manufacturers are being forced to respond to the challenge posed by Tesla and the like. It is striking that the traditional manufacturers are relying on well-known brands for electrification and – in contrast to the Chinese car manufacturers – are not creating any new brands for e-mobility.

At the same time, the companies are facing fundamental strategic challenges:

- On the one hand, combustion models must be further developed, as these generate profits and therefore funds for future investments.

- On the other hand, electric vehicles must be designed with new technology for a market that is still very volatile in some cases.

- In addition, there is a kind of renaissance of the plug-in hybrid in China, which was primarily triggered by the rapid success of Li Auto.

- The Chinese start-up is not relying on the plug-in variant with mechanical combustion engine drive, but is reviving the range extender concept that has already been rejected in Europe, in which the petrol engine only functions as an electricity generator.

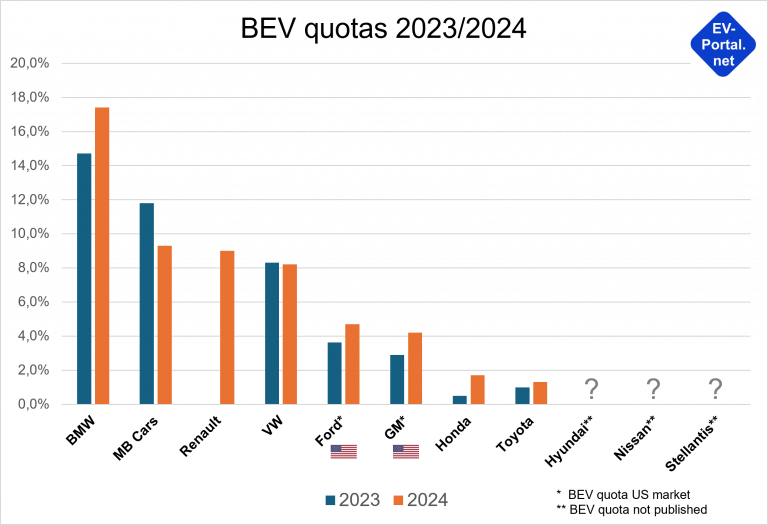

It is striking how differently the established vehicle manufacturers have relied on battery-electric drive systems to date. This is illustrated in the graph above by the BEV quota, i.e. the percentage of battery-electric models in the total sales of the respective manufacturer.

- The European manufacturers BMW, Mercedes–Benz, Renault and VW have already achieved a BEV quota of 8% or more of their vehicles sold worldwide in 2024.

- The US vehicle manufacturers GM and Ford are both at just over 4%, although the rate only relates to the US domestic market.

- The Japanese manufacturers Honda and Toyota bring up the rear with a BEV share of less than 2%.

- Unfortunately, Hyundai, Nissan and Stellantis do not communicate their BEV quotas, but are investing significantly in electromobility.

Summary of German manufacturers

The German OEMs with their strong premium brands have also come under massive pressure due to the disruption in the automotive industry. Press reports about job cuts and plant closures at OEMs and suppliers are coming thick and fast, politicians are alarmed and are organizing “car summits” in the Chancellery.

The reasons for this situation are complex and partly home-made, but the disruption caused by electromobility is a major factor:

- On the one hand, BEV sales in the home market of Germany have fallen significantly again due to the sudden stop of the subsidy premium at the end of 2023 and the associated market uncertainty.

- Secondly, revenue from the combustion engine business in China has collapsed because Chinese customers are increasingly switching to battery-electric vehicles from domestic production.

German manufacturers are driving electrification forward with different strategies:

- Volume manufacturer VW is focusing on a purpose-design approach with its ID models in combination with BEV-only production. In 2024, 8.2% of the vehicles sold by the VW Group were BEV models, with a total of 744,800 units sold.

This figure is still too low to fully utilize the production lines. The ID models are not popular in the highly competitive Chinese market, and the irritating ID3 interior with its difficult-to-operate air conditioning system is certainly not contributing to sales success. - BMW is faring much better with its integrated strategy: BWM is making very successful use of the reputation of its established combustion engine model series and is also launching these on the market as BEV variants.

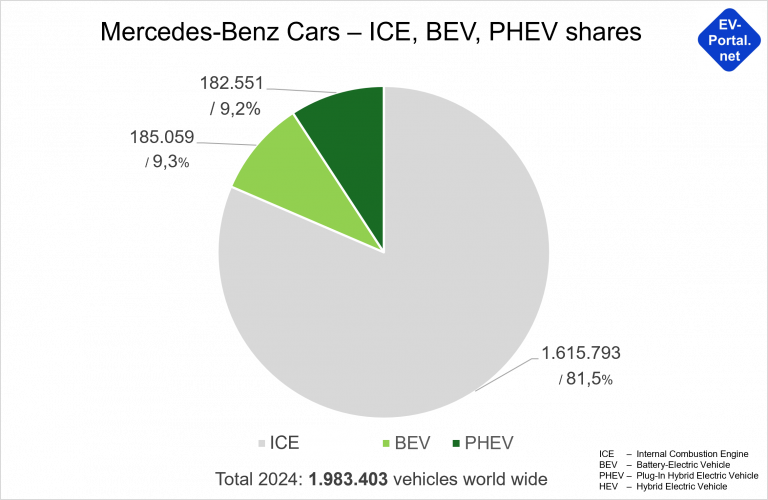

More than 17% of BMW Group vehicles sold worldwide in 2024 already had a battery-electric drive, making BMW the BEV world champion among the established car manufacturers. - For the entry-level models, Mercedes-Benz uses an integrated approach similar to BMW, while a dedicated BEV platform has been developed for the higher-end market segment. The EQ models based on this platform appear soft and do not necessarily meet the tastes of the traditionally conservative clientele, although the EQS is one of the world’s range champions.

Only 9.3% of Mercedes models sold in 2024 were equipped with a BEV drive, a figure that is significantly lower than that of BMW. Subliminally, Mercedes is giving the impression with the EQS that electric mobility is not yet mature enough for the “real” S-Class.

Summary of French manufacturers

The French vehicle manufacturers differed significantly in terms of their electrification strategy:

- Renault together with its long-standing Japanese partner Nissan, is one of the pioneers of electromobility, with 420,000 Renault Zoe produced between 2013 and 2024.

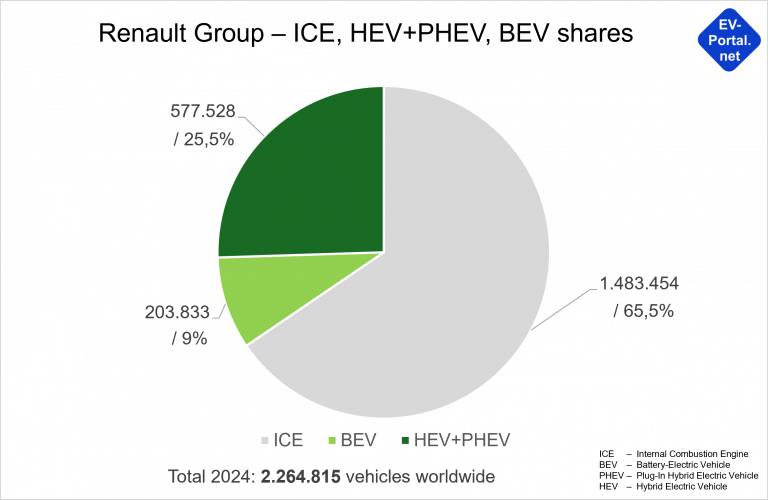

In 2024, 9% of Renault Group vehicles sold worldwide have been battery-electric vehicles. We expect the BEV rate to pick up in 2025 as the French carmaker unleashes a veritable retro fireworks display.

Iconic vehicles such as the R4, R5 and Twingo will be relaunched on BEV-specific platforms. - Citroen and Peugeot have now been merged into the multi-brand global group Stellantis.

With its platform strategy, the 14-brand group focuses on maximum flexibility in the drivetrain. All four Stellantis platforms each support a combustion, hybrid or battery-electric drive.

Unfortunately, the group does not communicate any drive-specific sales figures, i.e. the BEV quota of Stellantis is not known.

Summary of US manufacturers

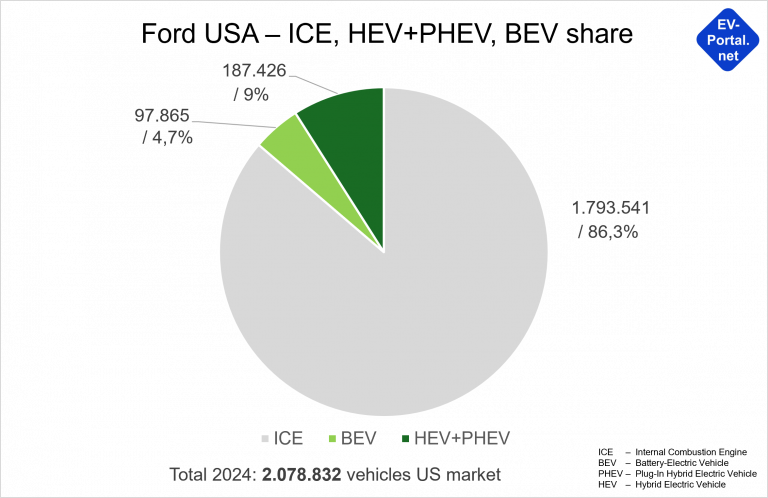

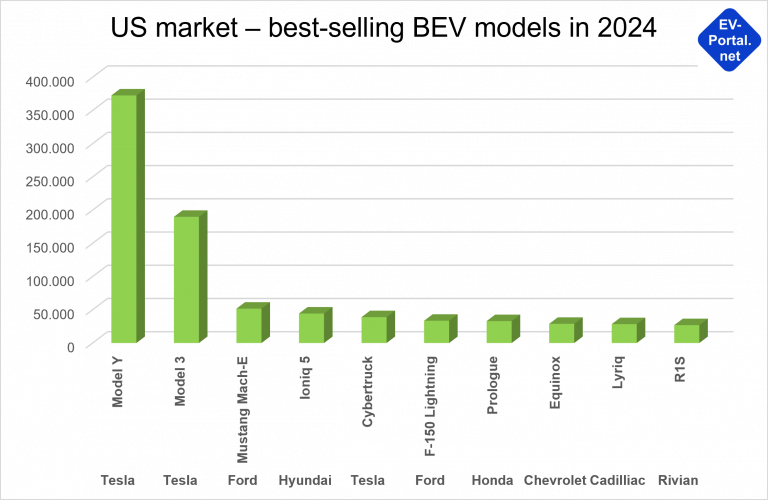

US car manufacturers GM and Ford reacted very cautiously to Tesla for a long time, but have since invested heavily in electromobility. In 2024, GM was in second place behind Tesla with 114,100 BEV models sold, while Ford was in third place in the US BEV ranking with just under 100,000 vehicles.

This means that the BEV sales figures for both manufacturers – in relation to the combustion engine models – are still in the single-digit percentage range, so the battery-electric models are not yet profitable.

It is striking that both manufacturers prefer to source lithium-ion cells from Korean suppliers for geopolitical reasons.

Stellantis has so far relied primarily on plug-in hybrids (PHEVs) for the electrification of its US brands Chrysler, Dodge and Jeep. According to its own figures, the company was the market leader in the PHEV segment in 2023 with 142,000 vehicles sold.

Summary of Asian manufacturers

Hyundai is one of the few Asian car manufacturers outside of China that is investing heavily in electromobility. Hyundai is the first volume manufacturer to develop a BEV platform with 800-volt technology. Based on this platform, Hyundai produces, among other things, the Ioniq 5, which in our opinion ideally combines new technology with iconic design.

Unfortunately, the company does not break down its sales figures by drive type, i.e. the proportion of BEVs among the Hyundai models sold is not known. However, the market data for 2024 shows that the Korean OEM is the fourth best-selling BEV model on the US market with the Ioniq 5. With 44,400 vehicles, the Ionic 5 is the most popular model from a foreign manufacturer.amit das beliebteste Modell eines ausländischen Herstellers.

It is noticeable that Japanese manufacturers are rather reticent when it comes to electrification. We will therefore not go into more detail on Japanese OEMs below, but will only briefly summarize here.

Toyota has been the world’s largest car manufacturer by volume for many years, with the Toyota Group producing 10.6 million vehicles in 2024. Although the Japanese carmaker has already taken a big step towards electrification with its hybrid technology, the company seems to be a prisoner of its success and stubbornly refuses to take the next step towards a battery-electric drive:

- Over 40% of Toyota Group vehicles sold in 2024 were either mild or fully hybrids, making the Japanese manufacturer the clear hybrid world champion with nearky 4.3 million MHEV or HEV models sold.

- In contrast, the company only sold 140,000 BEV models worldwide in 2024.

- With a BEV share of 1.4%, the Japanese car giant is one of the laggards in battery-electric drive systems.

- Toyota is one of the very few car manufacturers that has always relied on fuel cells in the passenger car sector. However, only 1778 fuel cell vehicles were sold worldwide in 2024 by Toyota.

If Toyota continues to act so conservatively, it will not be able to maintain its leading position. We predict that Toyota will lose market share to Chinese BEV companies such as BYD, especially in overseas markets in Asia, Africa and Australia.

Honda has also been rather cautious when it comes to battery-electric drives:

- Of the more than 3.7 million vehicles sold worldwide, only just under 65,000 had a battery-electric drive, which corresponds to a share of 1.7%.

- The company was most successful in the USA, where Honda landed in 7th place in the ranking of the best-selling BEV models in 2024 with ~33,000 Prologue.

- Interestingly, the Prologue is based on GM’s Ultimum platform and shares many components with the Chevrolet Blazer, of which only ~23,000 models were sold.

- Together with Sony, Honda has founded the BEV Joint-Venture Afeela, which is to produce vehicles for the US market from 2026.

Nissan is the only Japanese carmaker to have focused on battery-electric drives at a very early stage:

- Series production of the Nissan Leaf started back in 2010, making the model one of the first battery-electric vehicles to go into series production.

- By July 2023, a total of over 650,000 Leafs had been sold in more than 50 countries, with a total of over one million BEVs sold in Europe, Asia and North America by mid-2023.

- As early as 2007, Nissan entered into the production of lithium-ion cells in cooperation with NEC; the joint venture AESC was founded for this purpose.

However, Nissan is also one of the car manufacturers that has not yet been able to recover from the coronavirus-induced slump in sales. While sales figures were nearly at 5 million vehicles in 2019, only just over 3.3 million units were sold in 2024, which corresponds to a decline of more than 30%.

As a result, the Japanese manufacturer was unable to maintain the momentum from the pioneering years of electromobility:

- A cooperation partner is now being sought for the development of battery-electric vehicles. A collaboration with Honda is probably off the table again; talks are currently underway with the Chinese contract manufacturer Foxconn.

- The cell manufacturer AESC was sold to China in 2018.

Volkswagen

VW ID.3 – Exterieur

(Mit freundlicher Genehmigung/Courtesy of Volkswagen AG [Press Release])

VW ID.3 – Interieur

(Mit freundlicher Genehmigung/Courtesy of Volkswagen AG [Press Release])

VW - Sales figures

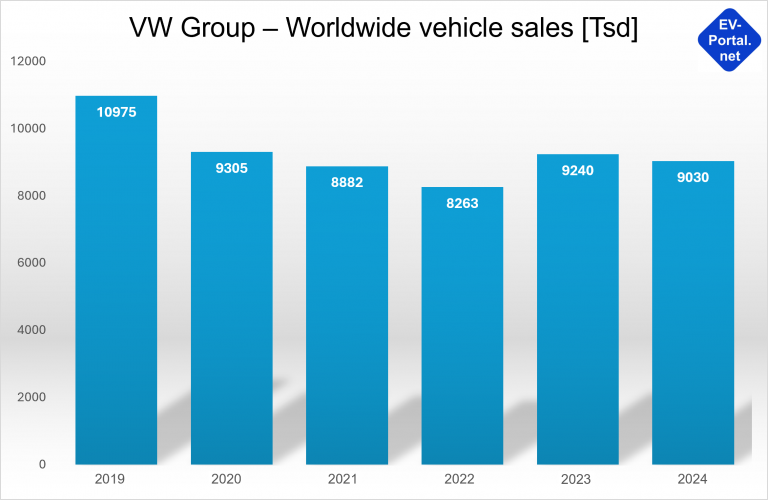

As a volume manufacturer, VW has been hit much harder by the current automotive crisis than the premium manufacturers BMW and Mercedes, which is also reflected in the sales figures for 2019 to 2024 (see chart):

- Global sales rose to a high of almost 11 million vehicles by 2019.

- Due to coronavirus and new competitors in China, sales fell to just under 8.3 million units by 2022, which corresponds to a decline of almost 25% compared to the 2019 peak.

- VW sales recovered by 2024, but at 9.03 vehicles are still almost 20% below the 2019 level.

In China, VW sales fell even more sharply between 2019 and 2024, from 4.2 million to just under 3 million vehicles, which corresponds to a decline of over 30%.

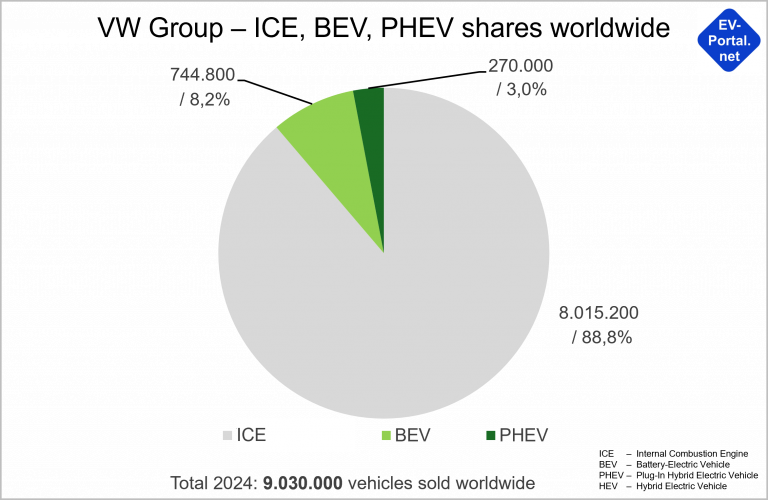

VW has invested massively in the electrification of the drivetrain, but still has a long way to go (see figure):

- The global share of combustion vehicles in VW’s total sales was still almost 90% in 2024.

- The global BEV share was just over 8%, which corresponds to 744,800 vehicles.

- Plug-in hybrids play a minor role with a 3% share of sales.

It is dramatic that the BEV share in China, at 7% with 207,400 units, is even below the global BEV average of 8.2%. By comparison, domestic competitor BYD sold more than 1.7 million BEV vehicles in 2024. In what is currently the world’s toughest automotive market, where 50% of vehicles sold are BEV or PHEV models, VW is clearly no longer meeting the tastes of Chinese customers.

VW also has a problem in the USA. In the ranking of the best-selling BEV models in 2024, the first vehicle from the VW Group only appears in 18th place. This is the ID.4, of which just over 17,000 models were sold.

The situation looks much better for VW in Europe, where the Wolfsburg-based car manufacturer was able to sell almost 450,000 battery-electric vehicles in 2024.

VW - BEV strategy

VW made its first attempt at electrification back in the early 1990s. In a large field trial on the island of Rügen, vehicles from various German manufacturers were converted to an electric drive and tested in everyday use. VW sent a Golf 3 with lead-gel batteries into the race, which had a modest range of 50-70 kilometres.

The first practical e-Golf appeared in 2014 and was built until 2020. This model was based on the Golf 7 and had a range of 200 km with the 35 kWh battery, which was available from 2017. The e-Golf was also very popular with members of the editorial team as a car-sharing model.

The ID.3, the first VW model designed purely as an electric car, then appeared in 2020.

Reactions to this vehicle were mixed, with praise for the spacious interior and the very good handling typical of VW. The futuristic operating concept for the air conditioning system can only be described as a disaster. The members of the editorial team have still not managed to switch on the heating during short city journeys in car-sharing models.

Overall, the interior of the ID.3 looks cheap compared to the clean interior of a Tesla Model Y.

The choice of name evokes the association that the ID.3 could be the successor to the VW icons Beetle (1) and Golf (2). It is already clear that the ID.3 does not fulfil this role. The ID.3 will certainly not become the hero of a film series or appear in the title of a non-fiction book on the bestseller list.

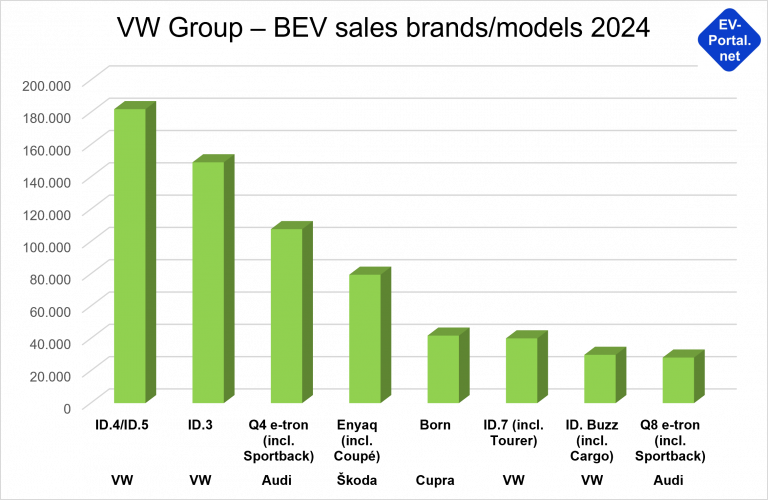

BEV distribution among brands and models in the VW Group in 2024

(Copyright: ev-portal.net)

VW ID.4 – BEV top seller in the VW Group in 2024

(Mit freundlicher Genehmigung/Courtesy of Volkswagen AG [Press Release])

After the ID.3, further ID models successively appeared as SUVs (ID.4, ID.5) and as a classic saloon and estate (ID.7).

The current distribution of BEV sales across the individual brands and models of the VW Group is shown in the table above; the top seller is the ID.4 (see illustration).

With the roll-out of the ID family, VW has opted for a purpose design approach to electrification – unlike BMW, for example. The good reputation of the well-known combustion models, some of which have cult status (‘Generation Golf’), remains unutilised.

It is questionable whether VW would not have been better off electrifying its established Polo, Golf and Passet model ranges. In the current phase of electrification, it is no longer about the so-called ‘early adopters’, i.e. early customers with an interest in innovations, but about the average consumer who simply wants to drive from A to B in an environmentally friendly way.

VW - Cell strategy

Li-Io cells are the key component of electrification and, together with the battery, form the largest cost block (approx. 40%) of an electric car. In order to better control cell costs, VW has decided to enter into cell production itself.

To this end, the VW subsidiary PowerCo was founded in 2022, which will produce the so-called “unified VW cell” from 2025. This is a prismatic cell that is standardised in terms of size and connections and is to be installed in 80% of all of the VW Group’s electric vehicles from 2030.

Cell parameters such as energy density and manufacturing costs can be varied using different cell chemistry variants such as LFP and NMC.

For the BEV models currently in production, VW sources its cells primarily from CATL, Samsung SDI and SK on, using cells in both pouch and prismatic formats, with NMC being used as the cell chemistry.

Addiotionally, VW also holds a 26% stake in the Chinese cell start-up Gotion. The company not only acts as a cell supplier, but will also support PowerCo in setting up its own cell production.

VW has now written off its 21% stake in the Swedish cell start-up Northvolt on its balance sheet after the Swedish cell start-up filed for creditor protection.

The negative example of Nothvolt shows how difficult and cost-intensive it is for newcomers to set up cell production. In this respect, VW’s plan to enter cell production can only be described as very courageous.

VW is conducting cell research in cooperation with its US partner QuantumScape, among others. The Californian start-up is working on an innovative cell design with a lithium-metal anode and ceramic separator; Sample cells have already been delivered to VW.

VW - Platform strategy

Like all high-volume manufacturers, VW also works with a platform strategy; VW currently has its own modular systems for electric vehicles and combustion engines.

VW currently uses two main platforms for electric vehicles:

- The modular electric toolkit (Modulare Elektrobaukasten MEB) was developed for high-volume compact and mid-range models from a cost perspective. All VW ID models as well as the Audi A4 Q4 etron, the Skoda Enyaq and the Cupra Born are based on the MEB platform.

- The so-called Premium Platform Electric (PPE) covers the mid to luxury class; unlike the MEB, this platform also supports 800-volt technology for fast charging. The PPE was primarily designed for Audi and Porsche models such as the Audi A6 e-tron and the Porsche Macan EV.

The MEB platform has been licensed by Ford Europe, i.e. the US manufacturer has decided not to develop its own BEV drivetrain for its European models Capri and Explorer.

There are also two platforms for VW’s combustion models, depending on the installation direction of the engine:

- The MBQ (German abbreviation for Modularer Querbaukasten = modular transverse toolkit) is used for all combustion models with front-wheel drive in which the engine is installed transversely. All newer models from VW, Seat, Skoda and the Audi A3 are based on the MBQ.

- The MBL (German abbreviation for Modularer Längsbaukasten = modular longitudinal matrix) was developed for all combustion engine models with rear-wheel drive in which the engine is installed longitudinally. This includes all Audi models from the A4 upwards as well as the SUV models from Porsche and the newer Bentley models.

In order to reduce the number of variants, VW is working on standardising the various BEV and combustion engine platforms. The aim is to create an integrated modular system for all drive types; the current working title is Scalable Systems Platform (SSP). In addition to drive harmonisation, the SSP should also enable automated driving according to Level 4 and over-the-air updates (OTA).

As the original launch date for the SSP had to be postponed from 2026 to 2028, the MEB is being extended again (MEB+). The main aim of this intermediate variant is to enable the installation of the VW unit cell. Further improvements concern the power electronics, with the aim of shortening the charging time and reducing power loss when driving.

However, a switch to an 800-volt architecture is not yet planned.

VW - Production strategy

VW manufactures its electric vehicles on production lines that are designed exclusively for the assembly of BEV models:

- When capacity utilisation is high, this approach is very efficient, as the assembly line can be optimised for exactly one model variant.

- In times of lower demand, mono-production is unfavourable. BMW and Mercedes therefore produce combustion engine and BEV models on one assembly line, which allows more flexibility in the event of fluctuating demand.

VW - Outlook

In Europe, VW is comparatively well positioned with its electrification strategy, even if the German domestic market is currently weak. Including combustion engines, however, VW has overcapacities of up to 25% in Europe. It remains to be seen how the Group, with its traditionally strong works council, will overcome this crisis – whether through plant closures or wage cuts.

The situation is different in China and the USA, where VW has a lot of catching up to do in the area of electromobility. Under CEO Oliver Blume, who has been in charge since 2022, VW has adapted its electrification strategy for both markets and the company is now focusing on greater localisation and cooperation with start-ups:

- In China, VW has acquired a stake of just under 5% in Xpeng and is working with the BEV start-up to develop an electric drive platform specifically for the Chinese market, known as China Electrical Architecture (CEA).

- In the USA, VW has founded a joint venture with Rivian to develop a drive platform for the US market. The Scout SUV brand is to be revitalised on the basis of this platform.

In addition to the cooperation with Xpeng, VW is developing BEV vehicles for the local market in China – together with its long-standing Chinese partner SAIC Motor. In particular, range extender models (REEV), which have become very popular in China thanks to Li Auto, are also to be developed.

It is unclear how these various development strands in the VW Group can be combined with the technologies already conceived, such as the MEB, MEB+ and SSP electric platforms.

The same applies to the development of vehicle software. The role of the VW subsidiary CARIAD (acronym for “Car I Am Digital”) has been significantly weakened by the initial co-operations with Rivian and Xpeng. Originally founded to harmonise the global software activities of the entire group, CARIAD will probably now focus on the European market. However, it is probably part of VW’s strategy to spark competition within the Group with regard to BEV and software development.

BMW

BMW iX and i3

(Mit freundlicher Genehmigung/Courtesy of BMW AG [Press Fotos])

BMW i7

(Mit freundlicher Genehmigung/Courtesy of BMW AG [Press Fotos])

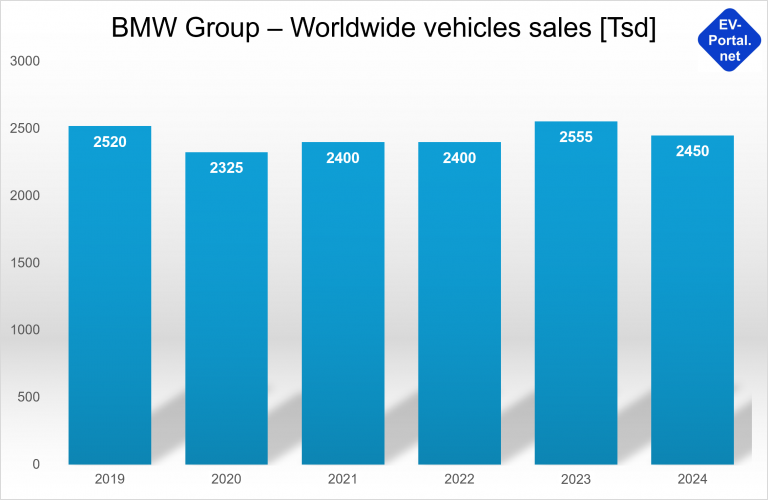

BMW - Sales figures

As a premium manufacturer, BMW is less affected by the current automotive crisis than the volume manufacturer VW (see figure):

- Until the outbreak of corona, global sales rose to more than 2.5 million vehicles in 2019.

- Due to coronavirus, sales fell in the following year, but the pre-coronavirus level of 2019 was already exceeded in 2023 with 2.55 million units.

- In 2024, sales fell slightly again and, at 2.45 million vehicles, were just under 3% below the pre-corona year 2019.

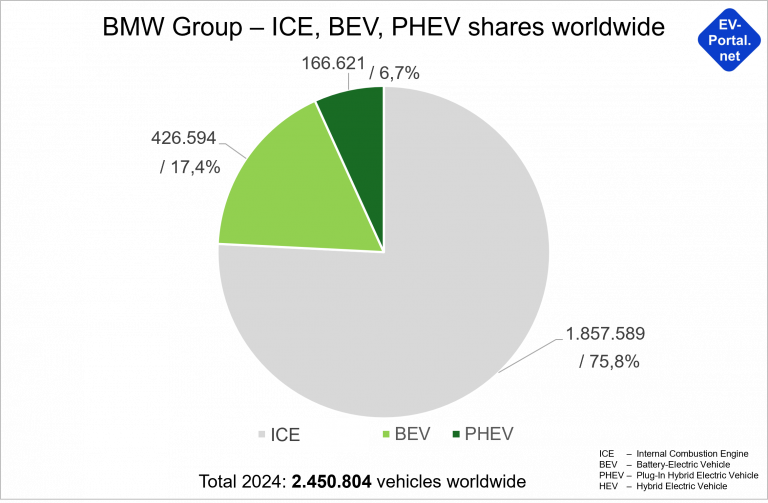

BMW is the BEV world champion among traditional manufacturers (see figure):

- 17.4% of BMW Group vehicles sold worldwide in 2024 (incl. Mini) were already battery-electric vehicles, a top figure compared to other traditional manufacturers.

- Just under 7% were plug-in hybrids, meaning that almost every fourth BMW Group vehicle is electrified.

Like all German manufacturers, BMW also has a problem in China, where sales including combustion vehicles fell by more than 13% in 2024. BMW has a home-made construction site with its new electronic braking system, which was developed in cooperation with Conti (brake-by-wire).

BMW - BEV strategy

BMW was also involved in the large-scale field trial of electric vehicles on the island of Rügen in the early 1990s. Modified models of the BMW 325iX were used, which were equipped with sodium-sulphur batteries (NaS).

The first all-electric i3 series vehicle was presented in 2013, initially with an optional range extender. The first models offered a range of 130 km, later versions reached up to 300 km. Only 250,000 i3 models were sold over a period of 9 years, and the i3 design, which in our opinion was very ugly, certainly did not contribute to its sales success.

The low number of units sold meant that the i3 was unable to recoup its development costs. One of BMW’s main conclusions was to refrain from further purpose-designed electric vehicles for the time being and not to develop any special BEV platforms.

The successor models to the i3 appeared in 2022 and were based on the modified CLAR (Cluster Architecture) combustion engine platform. These were the i4 saloon and the iX SUV (see illustrations).

With the i4, i5, i7, iX1, iX2, iX3 and iX models, BMW now has seven BEV series. The subsidiary brand Mini has two (Cooper and Countryman) and Rolls-Royce has one (Spectre). The company does not provide a breakdown of how many of each series have been sold. However, it is known that every fifth delivery of the X1 and BMW 7 Series is an all-electric variant.

BMW’s strategy of also offering its BMW 5 and 7 premium saloons as BEV models clearly sets it apart from Mercedes. While Mercedes has developed new model series for electric mobility with the EQE and EQS, which increase the number of variants and tend to scare off traditional customers due to their soft-edged design, the Bavarian manufacturer is relying on the appeal of its established combustion engine model series.

BMW is currently doing much better than Audi and Mercedes, with the Munich-based manufacturer alone selling more BEV models than Audi and Mercedes combined.

BMW - Cell strategy

BMW currently obtains its cells from CATL und Samsung SDI in prismatic format with NMC cell chemistry. The contract with Northvolt was canceled because the Swedish cell start-up was unable to supply sample cells in sufficient quality and quantity.

In connection with the development of the so-called “new class”, BMW is switching from the prismatic to the round cell format 46xx, i.e. cells with a diameter of 46 mm:

- Cylindrical cells are standardized in terms of their dimensions, which facilitates the application of a “second source” strategy.

- The fire risk of large, prismatic NMC cells with a high energy content is reduced.

BMW is therefore basically using the same cell format as Tesla, although the Munich-based company is opting for a different cell height than its US competitor. A cell height of 95 mm is planned for saloon cars, while SUVs will receive round cells with a length of 120 mm.

With the switch to the cylindrical format, the Chinese cell leader CATL remains an important cell producer for BMW; further supply contracts have been concluded with EVE Energy und AESC. According to unconfirmed information, a supply agreement has also been concluded with SVolt, the cell subsidiary of Great-Wall-Motos.

BMW is conducting research into new cell variants primarily in cooperation with the cell start-up Solid-Power:

- The US company delivered the first A-sample cells to BMW at the end of 2023. Solid Power is developing lithium-ion cells with a sulphur-based solid electrolyte, a silicon-enriched anode and a cathode with standard NMC chemistry.

- According to Kurt Vandeputte, Head of Battery Cell Technology at the BMW Group, it will take until the end of this decade before this technology can be industrialized.

BMW - Platform strategy

BMW’s current platform strategy is designed to integrate all drive variants into one platform:

- The UKL (German abbreviation for Untere Klasse = lower class) is used for smaller vehicles with front-wheel and all-wheel drive, such as the BMW 1 Series, the 2 Series Active Tourer and models from MINI. For electrification, the UKL was expanded into a FAAR platform (German abbreviation for Frontantriebs-Architektur = front-wheel drive architecture). This allows the use of combustion engines, plug-in hybrids and also purely electric drives.

- The CLAR platform (Cluster Architecture) is BMW’s larger models, from saloons to SUVs. Examples include models such as the BMW 3 Series, 5 Series and X5. This platform has also been revised for electric drives.

- One exception is the iX electric SUV, for which a separate BEV platform has been developed.

So far, BMW has done very well with its integrated platform concept. It is therefore all the more surprising that BMW has developed a purely electric drive platform for the so-called “New Class”, especially as its competitor Mercedes continues to rely on combustion engines for its new MMA platform.

We are very curious to see which platform concept will be more successful in 2025ff.

BWW - Production strategy

BMW manufactures its BEV models on the same production lines as its combustion models, which allows more flexibility in the event of fluctuating demand for BEVs.

The exception is the iX, which is only available as an all-electric model and has its own production line in Dingolfing.

BWW - Outlook

Among the traditional manufacturers, BMW is the electric world champion with a BEV share of more than 17%. With its integrated approach, the Bavarian manufacturer seems to be doing a lot of things right:

- In contrast to Mercedes, BMW is also using the appeal of its combustion engine series for electric vehicles.

- In contrast to VW, BMW has dispensed with pseudo-modern but completely impractical operating concepts and instead uses the tried-and-tested iDrive rotary dial in its BEV models.

- In contrast to Mercedes, BMW also designs its BEV models as estate cars (e.g. i5 Touring), a vehicle variant that is still very popular in Europe.

With all this success, it is all the more astonishing that BMW is abandoning its integrated strategy with the “New Class” in 2025 and switching to a BEV-only strategy in terms of platform, models and production. We are very curious to see how the Bavarian manufacturer will fare in the future with this change of strategy.

Mercedes-Benz Cars

Mercedes-Benz EQS

(Mit freundlicher Genehmigung/Courtesy of Mercedes-Benz AG [Press Fotos])

Mercedes-Benz EQB

(Mit freundlicher Genehmigung/Courtesy of Mercedes-Benz AG [Press Fotos])

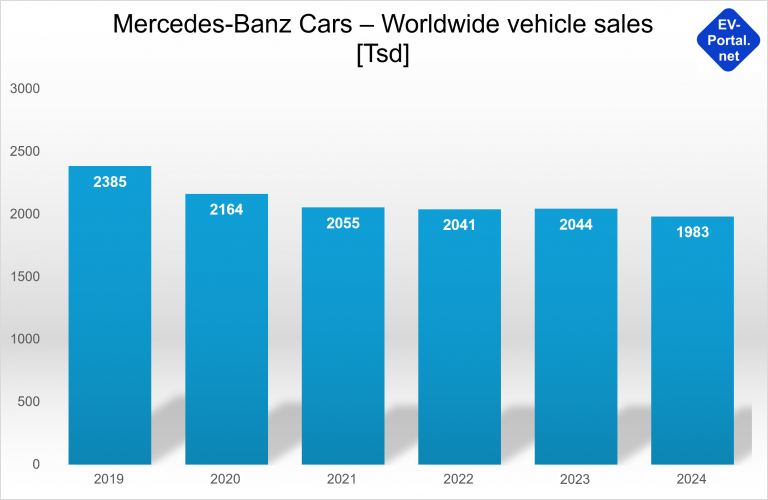

Mercedes-Benz Cars - Sales figures

In contrast to BMW, the sales figures for Mercedes-Benz Cars (excluding vans) no longer reached the pre-coronavirus level of 2019 (see chart):

- Until the outbreak of Corona, global sales rose to a high of almost 2.4 million vehicles in 2019.

- Due to coronavirus, sales fell to just arround 2 million units in the following years.

- However, since the switch to a “luxury strategy” propagated by Ola Källenius, the company has focused more on profit than unit sales.

The electrification figures from Mercedes-Benz Cars paint a mixed picture:

- BEV models accounted for 9.3% of Mercedes’ global sales in 2024, higher than VW but lower than BMW.

- However, Mercedes-Benz Cars is the plug-in winner among the three German OEMs with a share of 9,3%.

The main problem for the Swabian car manufacturer is the decline in S-Class sales in 2024, which fell by 25% in the first half of the year compared to the previous year. As a result, S-Class production in Hall 56 in Sindelfingen was reduced to a single-shift operation. Although the electric sister model EQS is produced on the same line, it cannot compensate for the slump in S-Class sales, as the sales figures for the EQS have also fallen well short of expectations.

The slump in S-Class sales is mainly attributed to weaker demand for luxury vehicles in China. At the same time, however, competition from BEV models in the premium segment has also increased.

In 2024, for example, the Geely Group already sold over 120,000 Zeekr 001 premium saloons in China between January and August.

Mercedes-Benz - BEV strategy

The inventor of the automobile is one of the pioneers of electromobility. The company has been researching electric vehicles since the early 1990s, initially focusing on fuel cell technology.

Battery-electric vehicles have also been tested at the subsidiary Smart since 2007. Production of a small series with lithium-ion batteries began as early as 2009, and in 2012 the third Smart generation was released for sale for the first time. At that time, the company also invested in its own cell production and the subsidiary Li-Tec was founded for this purpose

With all due respect for this early pioneering achievement, it should not be forgotten that the Tesla Model S, the first long-distance electric car with a then groundbreaking range of 500 km, also appeared in the same year.

In the following years, Daimler tested various electric drive technologies in pre-series models, including a B-Class with range extender technology, which had become very popular in China thanks to Li Auto. None of these models made it into series production, apart from small series with fuel cells.

The first BEV vehicle from the Mercedes brand to go into series production was an electric B-Class. This model was developed in cooperation with Tesla. The trigger is said to have been a visit by Dieter Zetsche to Elon Musk in Freemont, which ended with the quote “Let’s do something together”.

The Model S powertrain was then integrated into the then W246 B-Class, while the electric version was given the factory designation W242. Due to the limited installation space, the traction battery of 15.6 kW/h was significantly smaller than in the Model S parts donor, and according to the ADAC, the vehicle only achieved a range of 155 km. Interestingly, a few months earlier, the Mercedes Board of Management had halted the development of an electric B-Class with a self-developed electric drive.

Mercedes’ serious entry into electromobility only began in the mid-2010s with the development of the EVA2 platform (Electric Vehicle Architecture 2). EVA2 was the first electric drive kit to be designed for medium-sized and large premium vehicles.

Based on this platform, two BEV saloons and two BEV SUVs were subsequently developed, which have been marketed under the EQ sub-brand as EQS and EQS SUV and EQE and EQE SUV since 2021.

Although the models perform very well in tests and the EQS is one of the world’s range champions, the sedans’ soft, one-bow design does not seem to appeal to the traditionally conservative clientele. Subliminally, Mercedes’ decision to opt for a BEV pure-pose design conveys the impression that electric mobility is not yet mature enough for the “real” S-Class.

In contrast to BMW, Mercedes is thus missing the opportunity to transfer the reputation of its combustion engine model series to electric mobility. To the disappointment of European customers, the EQE – unlike BMW – is also not available as an estate.

The EQXX research vehicle, which achieved a sensationally low consumption of 7.4 kWh per 100 km on a long-distance trip in Dubai in March 2024, offers hope. Among other things, an extremely efficient drivetrain, a heat pump and solar cells on the roof contributed to this. The EQXX technologies are being incorporated into the new MMA platform, which will hopefully ignite the electric turbo for the inventor of the automobile.

Mercedes-Benz - Cell strategy

As a rule, Mercedes-Benz does not communicate its supplier relationships in detail. However, the company makes an exception when it comes to cell suppliers, as the South Korean government has been demanding that cell manufacturers be named since the fire in a Mercedes EQE.

The Chinese cell producers CATL and Farasis Energy Energy are among the main suppliers; the company also holds a stake of around 3% in Farasis. Further supplier relationships exist with SK On and LG Energy Solution. In addition to Farasis, Mercedes-Benz also holds shares in the French cell start-up ACC; the company is supporting the now Chinese producer AESC in setting up cell production in the USA. In both cases, this involves deliveries for future models.

In addition to Farasis, Mercedes-Benz also holds shares in the French cell start-up ACC; the company is supporting the now Chinese producer AESC in setting up cell production in the USA.

In both cases, this involves deliveries for future models.

Mercedes currently relies on cells in pouch format with NMC cell chemistry. With the introduction of the new MMA electric platform in 2025, a switch to the prismatic format is planned, and cells with LFP chemistry are then also planned for entry-level models.

The Swabian company is conducting research into new cell variants in cooperation with cell start-ups; one current trend is silicon enrichment of the anode:

- The US start-up Sila Nanotechnologies is working on a silicon-based drop-in material for the anode, which is intended to increase the capacity of Li-Io cells by up to 40%. The material is being used for the first time at Mercedes in the new electric G-Class G 580; the cell manufacturer is LG Energy Solutions.

- The Israeli start-up Store Dot wants to improve fast-charging properties with a similar technology; Mercedes has a financial stake in this company.

In the long term, lithium-ion technology will involve switching from a liquid to a solid electrolyte and the use of new active materials; the company is also cooperating with start-ups in this field of technology:

- Factorial Energy is developing a so-called semi-solid-state cell, which is said to have a 20-50% higher energy density. In addition to a lithium anode, Factorial is using a cathode with a sulphur compound. The details of the cathode were only published in September 2024 in cooperation with Mercedes-Benz; it can be operated at very high temperatures (approx. 90 degrees).

- The Taiwanese start-up ProLogium works with a classic NMC cathode in combination with a solid electrolyte. ProLogium uses two different technologies for the anode, based either on the silicon enrichment of the graphite anode or on a lithium-metal anode. Mercedes-Benz has held a financial stake in ProLogium since 2022.

Mercedes-Benz Cars - Platform strategy

Mercedes is pursuing a heterogeneous approach with its platform strategy:

- In the compact segment, Mercedes is taking an integrated approach with the MFA2 platform (Mercedes Front Architecture 2). The platform enables combustion, plug-in and BEV drives, although compromises must of course be made in terms of battery size. Current models based on MFA2 are the A- and B-Class, CLA, GLA, GLB combustion series and the EQA and EQB BEV models.

- For the large car segment, the company has developed the BEV–specific EVA2 platform, which is uncompromisingly optimized for electric drive and enables the installation of very large drive batteries. Since 2024, the EQS has been available with a battery capacity of 118 kWh, which represents a peak value in this segment. However, EVA2 does not yet support an 800-volt architecture.

The company is also planning specific platforms for the various market segments in the future:

The MMA platform (Mercedes-Benz Modular Architecture) will replace the MFA2 modular system from 2025. The MMA is primarily designed for electric drive, but can also accommodate combustion engines. Planned MMA models are the CLA as a saloon and shooting brake as well as the GLA and GLB as SUVs. Key MMA features include

- an 800-volt architecture,

- cells in prismatic format,

- low-loss power electronics with silicon carbide technology,

- a highly efficient electric drive with a 2-speed gearbox for the rear axle and

- an optional drive for the front axle.

The MMA will also feature an LFP battery for the first time at Mercedes. Only a 48-volt mild hybrid with an ISG concept is planned for the combustion engine, while a plug-in hybrid is not planned – despite the plug-in boom in China.

The trade press assumes that the EQ sub-brand will be discontinued with the appearance of the MMA models.

In the large car segment, a completely new platform development called MB.EA (Mercedes-Benz Electric Architecture) was also originally planned. Due to insufficient demand for EVA2 models, this plan was revised:

- MB.EA is to be used for the C-Class, which is already ready for series production. Particularly important is the electric GLC, which is due to be launched in 2026 and closes a critical product gap in the SUV segment. As the MMA has mutated into a rear-wheel drive platform (including all-wheel drive option), many MMA components can be reused in the MB.EA.

- The MB.EA-large platform planned for the larger models such as the E-Class and S-Class will not be further developed for the time being; instead, EVA2 will be revised to EVA2M. EVA2M also marks the switch to an 800-volt architecture.

Both platforms are designed specifically for BEVs, i.e. the coexistence of combustion engine and electric platforms will continue to pose challenges for Mercedes for some years to come. After all, the design of the BEV models should be closer to the established combustion models.

Overall, Mercedes’ current platform strategy seems less stringent than that of its competitor BMW. With a total of three electric platforms – MMA, ME.EA and EVA2M – and one combustion engine platform – MRA2 – to be further developed, the implementation of a common parts concept at Mercedes is significantly more complex than at BMW.

Mercedes-Benz - Productions strategy

Mercedes produces its BEV models together with combustion vehicles on the same production lines.

This strategy allows the company to react more flexibly to fluctuating demand for BEVs. For example, the EQS is produced together with the S-Class in Sindelfingen in the new Hall 56. The EQE is produced in Bremen together with the C-Class, among others.

Mercedes-Benz - Outlook

Mercedes-Benz’s decades of research in the field of electromobility are not yet reflected in the BEV sales figures. The reasons for this are not only to be found in the general reluctance to buy BEVs in important target markets such as the USA or Germany, but also in what we consider to be a suboptimal product strategy.

12 years after the launch of Tesla’s Model S, Mercedes still does not have an electric S-Class. The inventor of the automobile is thus subliminally signaling that electromobility is not yet ready for “the best car in the world”. However, another interpretation could also be: Mercedes is not (yet) in a position to build the best car in the world with an electric drive.

It is also incomprehensible why there should be no BEV estate for Mercedes-Benz customers – in contrast to Audi and BMW.

The many changes introduced at Mercedes-Benz under the new CEO Ola Källenius – abandonment of the S-Class Coupe, discontinuation of the A-/B-Class, no BEV estate, spin-off of Truck, outsourcing of sales, no more cab model, no long-term spare parts supply – may all seem right from a business perspective when viewed individually.

Ultimately, however, the question arises as to whether these measures as a whole are not undermining the brand essence at the front of Mercedes and thus diluting the identity of the Swabian car manufacturer in the long term.

As fans of the brand with the three-pointed star, we very much hope that the introduction of the MMA models in 2025 will herald a turnaround in electric mobility at Mercedes.

Renault

Renault Zoe

(Mit freundlicher Genehmigung/Courtesy of Renault S.A.[Home Page])

Renault R5

(Mit freundlicher Genehmigung/Courtesy of Renault S.A.[Home Page])

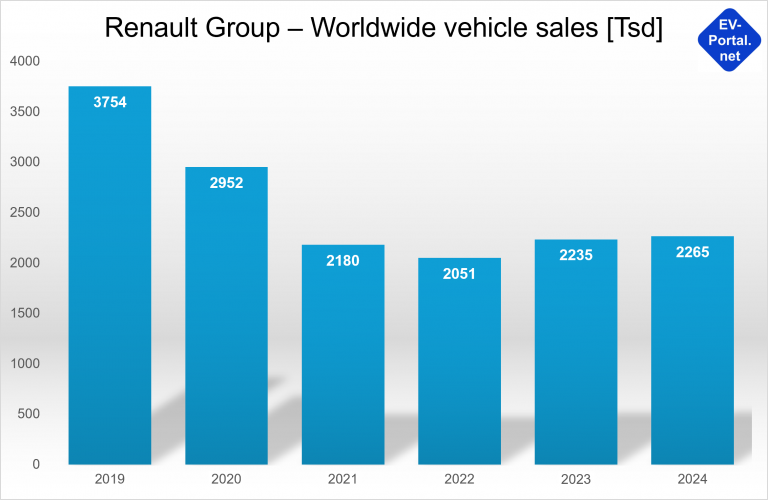

Renault - Sales figures

As a result of coronavirus, the Renault Group’s sales figures have slumped even more sharply than those of VW (see chart):

- By 2019, global sales had risen to over 3.7 million vehicles.

- Due to coronavirus, sales fell to just under 3 million units in 2020.

- In 2021, sales figures fell further to just under 2.2 million vehicles. This slump was caused by the separation from the Russian partner Avtovazm.

- In 2024, sales figures recovered slightly, but at just under 2.3 million units, they are still almost 40% below the 2019 level.

Renault is one of the pioneers of electromobility, which is also reflected in the comparatively high electrification rate (see figure):

- The BEV share of Renault Group models sold worldwide was just under 9% in 2024 and grew to 12% in Q4.

- The hybrid ratio was over 25%, although the company does not differentiate between PHEV and HEV.

Renault - BEV strategy

Renault is one of the few traditional manufacturers that has been investing in electric drives for a very long time. With 420,000 Renault Zoe models sold between 2013 and 2024, the company is one of the pioneers of electromobility.

The subsidiary Ampere was founded in 2022 to develop electric vehicles and the necessary software. Originally, an IPO was also planned, but this was canceled due to the current automotive crisis.

Renault’s BEV models include the Megane E-Tech and 2 van variants. With the R4, R5 and the Twingo, Renault will be setting off a veritable retro firework display in 2025.

With the Dacia Spring, Renault also offers affordable electric cars; the entry-level price for the basic model is currently just under 17,000 euros.

Renault - Cell strategy

Renault and its subsidiary Ampere have clearly communicated their cell strategy. Ampere is focusing on a diversification and localization strategy for cell procurement:

- LG Energy Solution is to supply LFP and NMC cells from its plant in Poland.

- From 2025, CATL will produce LFP cells for the French car manufacturer at its factory in Hungary.

- The now Chinese cell producer AESC will supply NCM cells for the R5, among others, from its French plant in Douai.

- From 2025, the French start-up Verkor will complete the quartet of suppliers with NCM cells.

Similar to VW, Renault is also planning to switch from the pouch to the prismatic cell format.

With regard to cell research, there is an interesting press release from Airbus from 2022, which announces a cooperation between Renault and Airbus in the field of solid-state cells. We are not aware of any further technical details about this collaboration.

In contrast to the German OEMs, which rely primarily on US cell start-ups for research into solid-state technology, the French car manufacturer appears to be taking a more cautious approach here. At least we are not aware of any participations or technology projects with US start-ups.

Renault - Platform strategy

Renault previously cooperated with its partners Nissan and Mitsubishi on the platform strategy. However, Renault would like to end this cooperation and is looking for buyers for its Nissan shares.

The combustion engine platforms are designated as CMF-A, CMF-B or CMF-CD according to the EU vehicle classification, whereby CMF stands for “Common Module Family”. Dedicated platforms have been developed for electric models, with 70% of the components being taken from the combustion engine platforms.

The designations for the BEV model kits are based on those of the combustion engines, the platform name is simply extended by the abbreviation EV:

- The CMF-AEV platform covers the A-segment, the most important representative is the Dacia Spring.

- The CMF-BEV platform forms the basis for the retro models R4, R5 and Twingo (B segment).

- The Megane E-Tech Electric and the Nissan Ariya are based on the CMF-EV (C-D segment). Here, Renault deviates from the naming convention and simply omits the letters CD, which stand for the EU vehicle classes.

The B-segment platform plays a special role in Renault’s future success. Compared to the ZOE, costs have been reduced by 30%.

Renault - Outlook

With the electrification strategy in the B segment, which is cleverly combined with the revival of iconic Renault models, the traditional French manufacturer appears to be well positioned. In addition, the share of BEVs in the domestic market is steadily increasing, reaching over 20% in 2024.

It is unclear what effect the separation from long-standing Japanese partners Nissan and Mitsubishi will have. The separation could have a negative impact on component costs if economies of scale are lost due to decreasing unit numbers.

In contrast to the German OEMs, Renault has not yet been active in the US market or in China, but is active in South America and North Africa.

Stellantis

Fiat 500e

(Mit freundlicher Genehmigung/Courtesy of Stellantis N.V. [Press Release])

Skizze Jeep Kompass

(Mit freundlicher Genehmigung/Courtesy of Stellantis N.V. [Press Release])

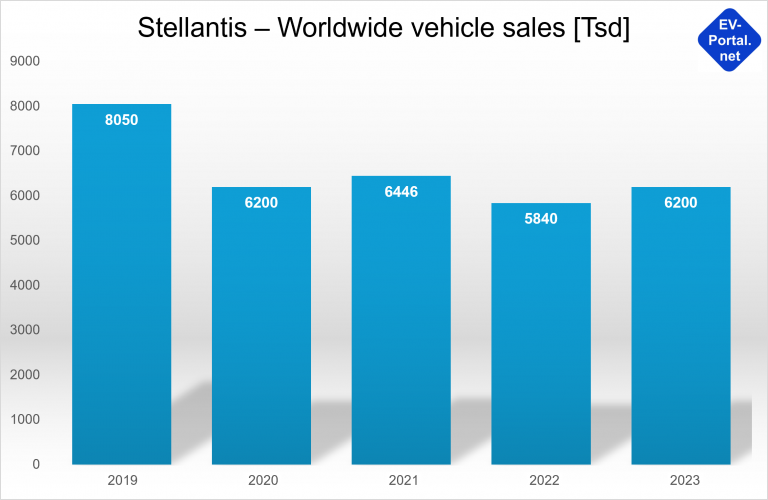

Stellantis - Sales figures

Stellantis is a multi-brand group that was created following the merger of FiatChrysler and Group PSA in 2021. The company now owns 14 brands, including well-known names such as Alfa Romeo, Chrysler, Citroen, Dodge, Fiat, Jeep, Opel, RAM and Renault.

The position of CEO is currently vacant. The former CEO Carlos Tavares is a pupil of José Ignacio López, the Opel manager who ruined Opel’s reputation through merciless cost-cutting with suppliers and subsequent quality problems.

The company is based in the Netherlands, but development and production are distributed worldwide.

Corona has also left its mark on Stellantis, as can be seen in the bar chart above:

- Before the corona outbreak, the still separate companies FiatChrysler and Group PSA together produced over 8 million vehicles.

- Due to coronavirus, sales fell to around 6.2 million units in the following years, which corresponds to a decline of over 20%.

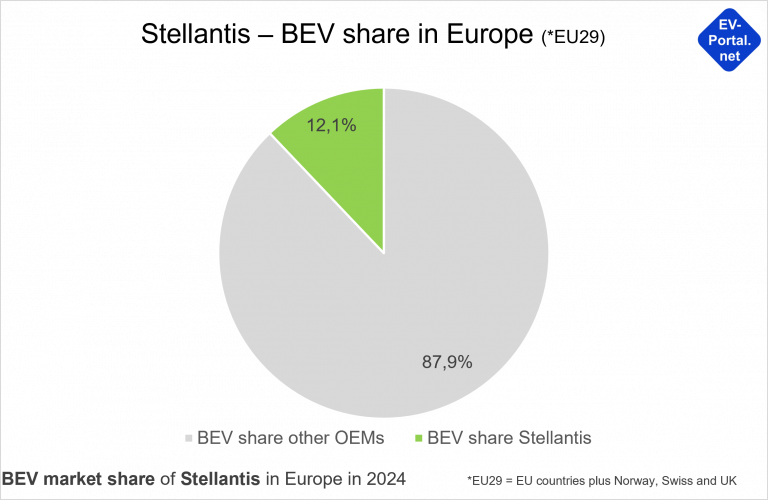

Unfortunately, Stellantis does not disclose the sales figures of the BEV models, only the market share in specific markets is communicated.

According to Stellantis, the company had a BEV market share of 12.1% in the passenger car segment in the EU29 countries (EU plus Norway, Switzerland and the UK) in 2024.

Stellantis - BEV strategy

In spring 2022, Stellantis published the so-called Dare Forward 2030 strategy, which envisages a very ambitious electrification of the model range. The aim is to achieve global BEV sales of five million vehicles by 2030, with 100% of cars in Europe and 50% of cars and light commercial vehicles (pick-ups) in the USA equipped with battery-electric drive systems.

An interim target for 2024 has already been missed, with only 40 BEV models (including vans) being launched on the market instead of the planned 45.

One of the Group’s best-known battery-electric vehicles is the Fiat 500, of which 65,000 were sold in 2023. In 2024, sales slumped by more than 2/3, which is why production at the Italian plant in Turin had to be interrupted. This was due to the comparatively high price and increasing competition.

BEV innovations in 2025 include the Fiat Panda in retro design, the Jeep Recon and various new Peugeot, Citroen and Opel models.

Similar to VW, Stellantis has also invested in a Chinese BEV start-up. In October 2023, the company announced an investment of 1.5 billion euros in Leapmotor, which corresponds to a 20% share. One of the first actions based on this deal is the European import of the T03 small car.

Stellantis - Cell strategy

Stellantis has also communicated its cell strategy in its Dare Forward strategy. The cell suppliers include the two South Korean manufacturers LG Energy Solution and Samsung SDI as well as the French cell start-up ACC.

Stellantis installs LFP and NMC cells in prismatic and pouch format.

Like the German OEMs, Stellantis conducts cell research by investing in cell start-ups:

- Stellantis has a stake in the US start-up Factorial Energy, which is developing semi-solid-state cells with up to 50% higher energy density. The technology is based on a lithium metal anode in combination with a cathode containing a sulphur compound. A small series of Dodge Chargers with factorial cells is to be produced in 2026.

- Another US start-up with Stellantis involvement is Zeta Energy. Zeta also relies on a sulphur-based anode; for the cathode, the start-up has developed carbon nanotubes that are enriched with lithium metal.

- The third start-up with Stellantis investment, Lyten, also works with a sulphur-based anode in combination with a graphene cathode.

Stellantis - Platform strategy

Of course, Stellantis is also working with a platform strategy in order to leverage synergies and economies of scale between the many brands. Existing platforms dating back to the time before Stellantis was founded are to be successively replaced.

The Stellantis platforms are basically designed for any type of drive, meaning that they can be used to build combustion, hybrid or BEV models. Three platforms for vehicles with self-supporting bodies and one platform for frame-based vehicles are planned or under development.

- The STLA Small platform covers the A to C segment and features 400 V architecture and the installation of LFP cells for batteries from 37 kWh to 82 kWh. Vehicles based on this platform were originally due to be launched on the market from the end of 2025, such as the Peugeot 2008, the Opel Corsa in 2026 and the Fiat 500. However, there are now increasing signs that the CMP platform acquired from PSA Groupe will be postponed and will continue to be used.

- STLA Medium is intended for the high-volume C and D segments, and vehicles based on this platform are already being sold. In the BEV configuration, NMC-based batteries with a usable capacity of up to 98 kWh and 400 V architecture are possible. The Peugeot E-3008, Peugeot E-5008 and the Opel Grandland are based on this platform.

- STLA Large was only presented at the beginning of 2024; this platform supports an 800 V architecture in the BEV version as well as batteries with up to 118 kWh of useful energy. It is aimed at the D and E segments; the first models are from Jeep and Dodge and primarily serve the US market.

- The STLA Frame will be the last platform to be presented to the public in November 2024. As the name suggests, this is about vehicles that are built on a frame, i.e. light trucks (pick-ups), large SUVs and delivery vans. The special feature of this platform is that range extender drives are also supported, with ranges of up to 1,100 km (690 miles) being possible. The first models are expected from the RAM brand in 2026.

Stellantis - Outlook

The Stellantis multi-brand group is in a similar phase to GM at the beginning of the 1930s. During this time, Alfred E. Sloan created the first modern multi-brand group by acquiring various vehicle manufacturers, which dominated the automobile market for 75 years.

While GM benefited from a growth market at the time, the development of Stellantis is taking place at a time characterized by stagnation and disruption in the automotive sector. It will therefore be a major challenge for the Stellantis management to position all 14 brands on the market to cover costs.

We assume that some brands will be discontinued in the medium term, as has happened at GM over the years.

Stellantis is taking a very conservative approach to electrification: all four platforms are designed for every type of drive. This approach enables a high degree of agility in the face of fluctuating BEV demand, but also requires compromises in the design of the BEV technology (e.g. in terms of battery capacity).

GM

EV1

(Mit freundlicher Genehmigung/Courtesy of Ford Motor Company)

Bolt EV

(Mit freundlicher Genehmigung/Courtesy of www.akkushop.de [Homepage])

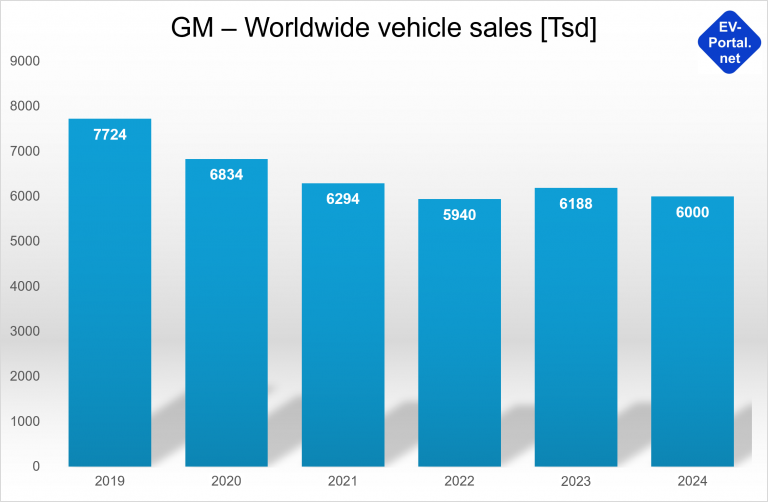

GM - Sales figures

General Motors (GM) was the world’s largest car manufacturer in terms of unit sales for more than 75 years and was only overtaken by Toyota in 2008. GM has also not yet been able to fully recover from the coronavirus-related slump in sales (see chart):

- In the pre-corona year 2019, GM sold just under 7.8 million vehicles.

- By 2022, the number of units had fallen to below 6 million, which corresponds to a decline of almost 25% compared to 2019.

- 2023 saw a slight recovery, with the Detroit-based company selling just under 6.2 million vehicles.

- In 2024, the figure fell back to the 2022 level.

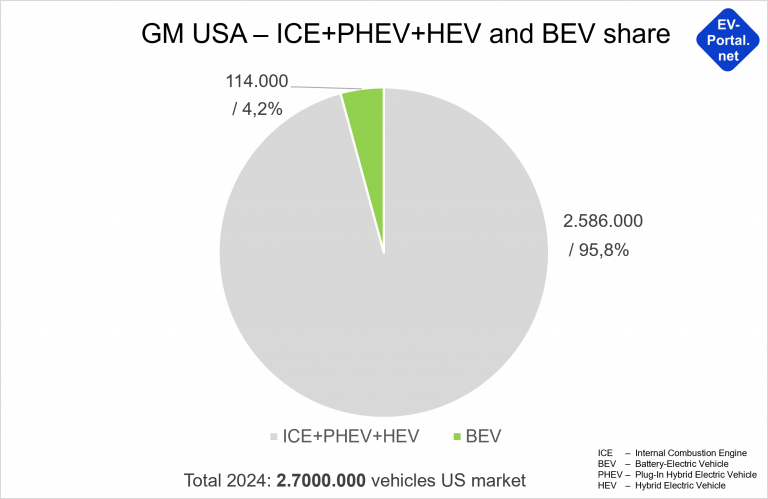

In the BEV ranking, GM achieved second place in the US market in 2024 with 114,400 vehicles, second only to Tesla. This means that 4.2% of GM vehicles sold on the US market were equipped with a battery-electric drive.

GM - BEV strategy

General Motors (GM) made its first foray into the world of electromobility back in the 1990s. Driven by Californian legislation, an electric vehicle called the EV1 was developed, initially with a lead-acid battery and later a nickel metal hydride storage system. The vehicle could only be rented and was taken off the market again – partly under protest from customers.

After the EV1, GM initially launched the Chevrolet Volt as a plug-in in 2010, and the first purely battery electric vehicle (BEV) appeared in 2016 (Chevrolet Bolt EV).

In the meantime, GM has significantly expanded its BEV product range, with current models including

- the Cadillac Lyriq in the premium segment,

- the GMC Hummer EV as a pickup or SUV and

- various Chevrolet models such as the Blazer EV Equinox EV and Silverado EV.

GM was the second OEM after Ford to enter into a cooperation with Tesla to use the Supercharger charging network. The Tesla network consists of more than 12,000 charging stations in the USA and is considered to be very reliable.

GM - Cell strategy

As the inventor of the platform concept, GM is also striving to implement a common parts strategy for its BEV models. To this end, the Ultium battery system was developed with LG Energie Solution in 2020, which is based on large-format, stackable pouch cells with NMC chemistry.

The special technical features include a wireless communication system that allows the battery modules to communicate with the battery controller. The so-called wBMS (Wireless Battery Management System) was designed in cooperation with Analog Devices.

Following production problems at module and battery level and vehicle fires in the Bolt EV, GM announced a revision of the Ultium technology in October 2024:

- A second Korean cell supplier, Samsung SDI, was selected.

- Instead of pouch cells, prismatic cells will be used in future.

- In addition to NMC cells, LFP cells will also be installed.

The change in strategy was initiated by Kurt Kelty, who has been the new chief strategist for battery systems at GM since the beginning of 2024. Kelty was responsible for battery technology at Tesla until 2017.

GM conducts cell research primarily in cooperation with start-ups:

- The British start-up Addionics has developed a three-dimensional film material for the anode and cathode, which is intended to improve the mechanical stability and safety of Li-Io cells. GM has had a financial stake in the company since 2024, possibly also due to the vehicle fires in the Bolt EV.

- OneD is one of the start-ups developing materials for silicon enrichment of the anode; GM has held a stake in this company since 2022. The company from Palo Alto, California, produces so-called nanowires made of silicon, which are added to the graphene in the anode. The silicon allows the anode to absorb more lithium ions, which increases the capacity of the cell.

GM - Platform strategy

With the Ultimum platform, GM has developed a universal BEV modular system with a very high degree of variability. This enables the construction of compact vehicles, full-size SUVs, light trucks and commercial vehicles (delivery vans).

- The core element of the platform are pouch cells with different sizes and capacities, which can be stacked both vertically and horizontally to form modules.

- The modules can be used to create battery packs with a capacity of up to 200 kWh.

- A variety of drive configurations are also supported, ranging from rear-wheel drive with one electric motor to all-wheel drive with two motors and power drive with three electric motors.

Until recently, GM branded the name Ultimum as its own brand, but the company is now refraining from doing so. However, the technology kit for which the Ultimum name stands will continue to be used.

GM - Outlook

General Motors is an icon of the automotive industry, with a large number of innovations in the automotive sector to its credit. These include the platform concept in combination with finely balanced brand management.

For over 75 years, the company was the world’s most successful car manufacturer, only being overtaken by Toyota in 2008. The reasons for the loss of the top position are manifold; in our opinion, financial managers have dominated too much over technologists in recent decades.

We are curious to see how the Detroit-based company will fare in the future. After all, GM managed to sell more BEV models on the US market than its long-term rival Ford in 2024.

Ford

Ford Mustang Much E

(Mit freundlicher Genehmigung/Courtesy of Ford Motor Company)

Ford F150 Lightning

(Mit freundlicher Genehmigung/Courtesy of www.akkushop.de [Homepage])

Ford - Sales figures

Ford has also not yet been able to fully recover from the consequences of the coronavirus pandemic (see chart):

- While global sales in 2019 were still just under 5.4 million vehicles, this fell by more than 20% to just over 4.2 million units in the first coronavirus year of 2020.

- A slight recovery set in from 2022, with sales rising to over 4.5 million units by 2024, which corresponds to a share of 84% compared to 2019.

In 2024, Ford sold almost 100,000 BEV models on the US market, which corresponds to a 4.7% share of Ford’s total sales (see figure). The share of hybrids (HEV and PHEV) was 9%; unfortunately, Ford does not provide a precise breakdown of plug-in hybrids.

Ford - BEV strategy

Ford began its entry into the battery electric vehicle (BEV) market with the launch of the Focus Electric in 2011, a compact electric car based on the Ford Focus. Another milestone followed in 2020 with the launch of the Mustang Mach-E, an electric SUV that reinterpreted the iconic muscle car of the 1960s.

In 2022, Ford launched the F-150 Lightning, an all-electric version of the best-selling pickup in the US, adding a vehicle in the commercial vehicle segment to its BEV portfolio. With further investments in new platforms and production facilities such as the BlueOval City plant, Ford is focusing on electrification to meet the increasing demands of the BEV market.

The very ambitious target of 2 million BEVs sold in 2026, which was set a few years ago, has been revised as the US customer is much more reluctant to buy BEVs than originally assumed. Production of the next electric pickup has been postponed from 2025 to 2027. The three-row SUV originally conceived as a BEV model is now being developed as a hybrid model.

The cost structure is also a challenge; according to Ford, the BEV business is expected to remain unprofitable until at least 2026.

The central production facility is the BlueOval City in Tennessee, a production complex for electric vehicles and batteries. The technological basis for the Mustang Mach-E is the so-called GE1 platform (Global Electrified #1), while the F150 Lightning is built on a modified ladder frame from the F150 combustion series.

Ford was the first car manufacturer to enter into a partnership with Tesla to use the Tesla charging network. This gives Ford customers access to Tesla’s Superchargers with more than 12,000 stations in the USA. The network is now known as the NACS (North American Charging Standard) network, as many OEMs have followed Ford’s example.

In addition, Ford is also expanding its own FordPass charging network, which currently comprises over 63,000 charging points through partnerships with providers such as Electrify America.

Ford - Zell-Strategie

Ford’s cell strategy is based on partnerships with cell suppliers:

- One of the most important partners is SK On, from which Ford sources pouch cells in NMC format for the Mustang Mach-E and F-150 Lightning. The cells currently come from South Korea; from 2025, the plants under construction in Kentucky and Tennessee will supply cells. These will be operated as part of a joint venture.

- Ford has another South Korean supplier, LG Energy Solution. This company also supplies pouch cells in NCM format, which are produced in Poland. LG is also planning to localize cell production and, together with Ford, is building a production facility in Michigan, which should be operational from 2025.

There are also plans to collaborate with CATL, primarily on LFP cells. Whether the Chinese cell giant will be allowed to set up a production facility in the USA, however, remains to be seen under the current political conditions.

Ford conducts cell research primarily in cooperation with start-ups:

- Together with BMW, Ford is involved in Solid Power. The US start-up is developing a solid-state Li-Io cell with a silicon-enriched anode.

- Through the United States Advanced Battery Consortium LLC (USABC) – an organization founded by Ford, General Motors, Stellantis and the US Department of Energy – Ford has also invested in two US start-ups for innovative anode material. These are the companies Nanograf and Ionblox, both of which produce silicon-doped anode material.

Ford - Platform strategy

The first BEV platform developed by Ford, GE1 (Global Electrified #1) – in contrast to GM’s Ultimum platform – only supports the construction of cars such as the Mustang Mach-E, but is not suitable as a construction kit for light trucks (“pick-ups”).

For the F150 Lightning, Ford therefore had to modify the F150 combustion platform to accommodate the heavy batteries and create space for the installation of the electric motors and power electronics.

As the sales figures for the F150 Lightning fell far short of expectations, Ford fundamentally revised the platform concept once again:

- A BEV platform called TE1 (Truck Electric #1) is being developed for the light truck segment under the project name T3 (Trust The Truck). According to Ford CEO Jim Farley, the T3 project is intended to merge “100 years of Ford truck expertise with world-class electric vehicle, software and aerodynamic talent”.

- Ford CEO Farley also said in his announcement that the new model may not look like a truck, but it will behave like one. Apparently, Ford is being influenced here by the design of the Tesla Cybertruck.

- The production site is the so-called BlueOval City, a new Ford plant 80 kilometers northeast of Memphis in the state of Tennessee. The plant is to be designed for an annual capacity of 500,000 vehicles, with the start of production (SOP) planned for mid-2027.

- Full-size SUVs are also to be developed and produced on the basis of the TE1 platform.Auf Basis der TE1-Plattform sollen auch Full-Size SUVs entwickelt und produziert werden.

However, the T3 project is not Ford’s only platform project:

- Ford has set up a new development center for electric vehicles in Long Beach in the south of Los Angeles.

- The 450-strong team is working in innovative and lean development processes on electric vehicles that can be offered at an entry-level price of around 25,000 US dollars.

- The project is headed by former Tesla manager Alan Clarke.

- The location in California is intended to attract talent from various engineering fields, including software developers.

- The first products are expected in 2026 or 2027.

In Europe, Ford is pursuing a completely different platform strategy. Here, the company is not relying on its own development, but has licensed the MEB platform from VW. Current models based on the MEB platform are the Ford Capri and Explorer.

Ford - Outlook

In the US market, Ford has been the market leader in light trucks (pick-ups) for almost 40 years with its F-Series. More than 55% of Ford models sold in 2024 were in the light truck category, and the successful electrification of this segment is of strategic importance to Ford.

So far, competition in the electrified light truck segment has not yet been fully established. We are curious to see how the inventor of assembly line production will fare here in the future.

Hyundai

Hyundai Ioniq 5

(Mit freundlicher Genehmigung/Courtesy of Hyundai Motor Company [Press Release])

Hyundai Ioniq 6

(Mit freundlicher Genehmigung/Courtesy of Hyundai Motor Company [Press Release])

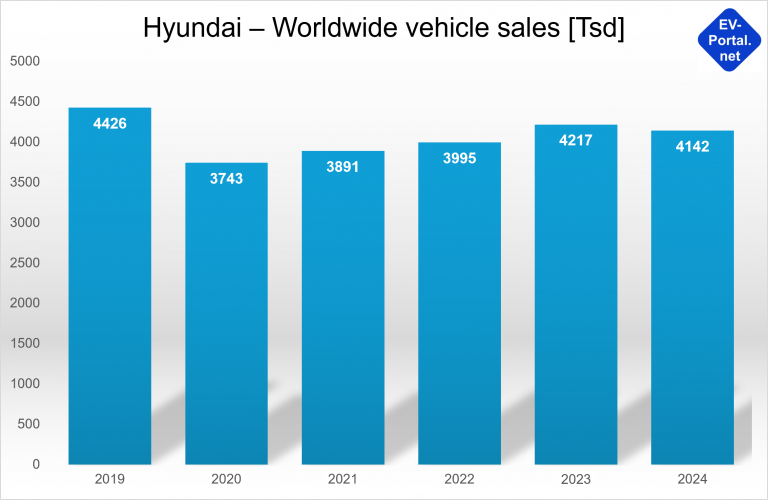

Hyundai - Sales figures

Hyundai is one of the few volume manufacturers that was able to almost completely compensate for the coronavirus-induced slump in sales (see figure):

- In 2019, sales exceeded 4.4 million vehicles, but slumped by more than 15% to just over 3.7 million units in the first corona year of 2020.

- This was followed by a steady recovery, with the Korean manufacturer selling over 4.1 million units again in 2024, which corresponds to almost 94% of the pre-corona level.

Unfortunately, Hyundai does not break down its sales figures by drive type. What is known, however, is that the Ioniq 5 will be the fourth best-selling BEV model in the USA in 2024, taking first place among non-US manufacturers (see figure).

Hyundai - BEV strategy

Hyundai entered the BEV market in 2018 with the launch of the Hyundai Kona Electric, a compact electric SUV with a range of up to 482 km (according to WLTP).

An important step was the introduction of the E-GMP platform (Electric Global Modular Platform) in 2020. This platform was specially developed for electric vehicles and is the first BEV platform in the volume segment with 800-volt technology.

The first model based on the E-GMP is the Hyundai Ioniq 5, an innovative crossover with a futuristic design, fast-charging capability thanks to 800 volts and a range of up to 507 km (WLTP).

With the Ioniq 5, Hyundai has proven in our opinion that it can not only compete with established electric car manufacturers such as Tesla, but also bring its own innovations and designs to the market (see illustration).

As an alternative to the Ionic 5, Hyundai has developed the Ionic 6, a very streamlined car especially for long distances, which is based on the same technology (see illustration).

The Hyundai Group also includes the subsidiary Kia and the luxury brand Genesis. Hyundai has BEV models in its portfolio for both brands, including the Kia EV6 and the Genesis GV60.

Hyundai is also planning to enter the market for electric vertical take-off and landing vehicles (eVTOL) via its subsidiary Supernal Aero. Supernal is developing a wing-based eVTOL.

Hyundai - Cell strategy

Hyundai is currently relying on the classic supplier model for cell procurement:

- In Hyundai’s first BEV model, the Kona, prismatic NMC cells from CATL were installed.

- With the introduction of the GMP platform, Hyundai switched to the pouch format. SK on was selected as the cell supplier for the Ionic 5 and LG Energy Solution for the Ionic 6.

In the medium term, the Korean car manufacturer wants to enter the cell production business itself – similar to VW. The main focus here is on the production of LFP cells, which have been pushed in recent years primarily by Chinese cell manufacturers such as BYD and CATL.

Hyundai would like to source recycled iron from its steel subsidiary Hyundai Steel in order to become less dependent on imports. Production is planned from 2025.

Hyundai is also conducting cell research in cooperation with start-ups:

- The US start-up Factorial Energy is developing semi-solid-state cells with up to 50% higher energy density; the technology is based on a lithium-metal anode in combination with a sulphur cathode.

- Another partner is SES AI, this start-up is also working on cells with a lithium metal anode.

According to current Korean sources, Hyundai is also working on the development of solid-state cells itself. It is not known whether technology partners Factiorial or SES are playing a role in this, or whether it is a completely in-house development.

The first vehicle tests with solid-state cells are planned for the end of 2025.

Hyundai - Platform strategy

The Electric Global Modular Platform (E-GMP) was presented by Hyundai back in 2020 as a central BEV modular system:

- E-GMP covers EU vehicle classes A to E, but currently Hyundai has only developed category C (Ionic 5, Kia KV6) and D (Ionic 6, Genesis G60) vehicles based on E-GMP.

- The E-GMP was the first platform in the volume segment to support an 800-volt architecture. This makes it possible to charge the battery from 20% to 80% within 18 minutes.

- The platform supports vehicles with rear-wheel drive (standard) as well as optional all-wheel drive. In all-wheel drive mode, a clutch enables the front wheels to be engaged as required.

The E-GMP is to be further developed into an Integrated Modular Architecture (IMA). IMA will not only standardize the chassis, but also the battery system and the motors. There are plans for 13 new electric models by 2030 and the use of cell-to-pack technology.

E-GMP and IMA are pure BEV platforms; Hyundai has other technology modules for combustion engines and hybrids.

Hyundai - Outlook

The Korean car manufacturer is one of the few high-volume manufacturers to have recovered almost completely from the coronavirus crisis. With the Ioniq 5, the company is very successfully demonstrating that innovative technologies (e.g. 800-volt architecture) in combination with an attractive design are definitely possible.

With its dedicated BEV platforms, the company is signaling that it believes in the rapid electrification of the automotive sector.

But the world is not perfect for Hyundai. Like almost all traditional manufacturers, Hyundai has come under massive pressure in China in recent years. While sales in 2026 were still over one million vehicles, by 2023 they had fallen by 75% to just under 249,000 vehicles.

Hyundai is planning its own Chinese models from 2025, and we are curious to see how successful Hyundai will be with this strategy.