Index A-Z - Street

Aehra Afeela Aito AI-WAYS Aptera ARI Motors Arrival Avatr BeyonCa BYD Byton CANOO Ceer Cenntro Delorean Evergrande New Energy Auto Evum Motors Faraday Future Fisker GAC Aion Hozon Auto (Neta) Human Horizons Hycan IM Motors Ineos Automotive Izera Leapmotor Li Auto Lightyear Liux Lordstown Motors Lucid Motors Mullen Technologies Munro Vehicles Neta Auto NIO Olymp Cars Ora Polestar REE Automotive Rimac Automobili Rising Auto Rivian Automotive Seres Slate Auto Sono Motors Tesla Togg Auto Vinfast Voyah Xiaomi Xpeng Zeekr

Aehra is a BEV start-up startup from Italy that claims to combine Italian design, world-class engineering, and American customer service [1].

AEHRA plans to launch two models: a large SUV coupe and a four-door sedan. Both vehicles will be based on a newly developed, all-electric platform and equipped with a 120 kWh battery. The target range is around 800 kilometers, with a top speed of around 265 km/h.

The interior features a very wide, fully digital front display across the entire width of the vehicle and a second control panel in the center console. The cockpit uses a yoke-like steering wheel and follows a minimalist, futuristic operating concept. Despite its sporty proportions, the interior is expected to be spacious.

Aehra SUV

(Mit freundlicher Genehmigung/Courtesy of AEHRA Inc. [Homepage])

Aehra Limousine

(Mit freundlicher Genehmigung/Courtesy of AEHRA Inc. [Press Kit])

In terms of price, AEHRA is clearly positioned in the upper premium segment; the expected price per vehicle is around €160,000 to €180,000. Production is scheduled to start in 2026 at the earliest, with a possible ramp-up in production from 2027.

There are indications of financial and structural challenges in the company’s development. Several media outlets report that the start-up has so far lacked important investors and technical partners, which has already led to delays in the originally announced schedule. AEHRA has also applied for substantial government subsidies to enable it to build up its own production capacities. This dependence on external sources of financing and the postponement of the start of production indicate that the business model is currently under increased financial pressure.

Sources

[1] https://www.aehra.com/ (Homepage, Access 27.09.2022, 13.09.2023)

[cs 27.09.2022, 13.09.2023, 01.12.2025]

Afeela is a new brand of the BEV joint-venture of Sony and Honda, which was founded in 2022 under the name Sony Honda Mobility Inc. The aim is to combine the respective competencies in the field of electronics and automotive engineering [1].

Sony wants to tap into the fast-growing market for automotive IT systems like Huawei and Alibaba, and is entering the automotive market via a joint venture. Honda gets a partner for the electrification of its product range, where there is definitely a need to catch up.

The first production model is a large, five-door sedan, with production scheduled to begin in the US in 2026. The vehicle uses two electric motors with all-wheel drive and a battery with around 91 kWh. The interior is largely based on Sony’s digital and entertainment focus. The cockpit consists of a wide display front with software-centered operating logic.

Afeela relies on an extensive sensor structure consisting of around 40 units, including cameras, radar, and LiDAR, to enable advanced assistance functions and semi-autonomous driving. This is complemented by comfort features such as air suspension and a modern interior design.

Afeela – Exterieur

(Mit freundlicher Genehmigung/Courtesy of Sony Honda Mobility Inc. [Gallery])

Afeela – Interieur

(Mit freundlicher Genehmigung/Courtesy of Sony Honda Mobility Inc. [Homepage])

Afeela is positioned in the premium segment, with entry-level models starting at around $90,000 and higher-spec versions costing around $100,000. The market launch will initially focus on North America.

For the fiscal year ending March 2025, Sony Honda Mobility reported an operating loss of around ¥52 billion (≈ $360 million). The introduction of a new premium EV requires high investments in software, sensor technology, and production setup and takes place in a highly competitive market segment. Despite these risks, however, the project is considered financially secure, as both owners—Sony and Honda—are very capital-strong corporations and offer the necessary stability for the start-up phase of the joint venture.

There is still no information about the powertrain components, such as the electric motor or the HV battery.

Sources

[1] https://www.shm-afeela.com/en/ (Homepage, Access 07.02.2023)

[cs 07.02.2023, 02.12.2025]

Aito is a Chinese electric vehicle brand developed and produced by the Seres Group, with Huawei involved in the design, software, and sales as a technology and distribution partner [1]. Huawei itself does not own the brand, but supplies key systems such as its HarmonyOS operating system and technologies for the assistance systems. In addition, Huawei sells Aito brand vehicles through its own showrooms.

Due to the close cooperation between Seres and Huawei, Aito is considered a BEV joint venture, even though it is not a joint venture in the legal sense. The aim of the collaboration is to create synergies between an electronics group and an automobile manufacturer:

- Huawei wants to tap into new markets and place its products in cars.

- Seres benefits from the IT expertise of its electronics partner.

AITO is positioning itself in the luxury segment, focusing primarily on SUV models with electric or range extender drives.

After its market launch, AITO quickly became one of the fastest-growing brands in the Chinese premium EV segment. According to official figures, the brand achieved sales of around 94,000 vehicles in 2023. This was followed by a significant increase to a total of around 387,000 units in 2024, driven primarily by the success of the large AITO M9 SUV, which achieved sales of over 200,000 in its first year. Complete annual figures for 2025 are not yet available, but by August 2025, AITO had reported cumulative deliveries of around 770,000 vehicles since its market launch, meaning that high sales levels can once again be expected for 2025.

Aito M5 EV – Exterieur

(Mit freundlicher Genehmigung/Courtesy of Aito [Press Release])

Aito M5 EV – Interieur

(Mit freundlicher Genehmigung/Courtesy of Aito [Press Release])

AITO is now also working on international expansion. At IAA Mobility 2025, the brand unveiled its first global model range with a view to gaining a foothold outside China. Initial indications suggest that individual models are also intended for the European market, but a specific market launch in Europe has not yet been confirmed. The focus of sales remains clearly on China.

Publicly available financial figures on the brand’s sales or profits are currently not available. The Seres Group does not publish separate financial figures for AITO, so the economic assessment is mainly based on sales volume and market presence.

Overall, AITO is showing strong growth, driven by a broad SUV portfolio, technological support from Huawei, and aggressive market dynamics in China. How the brand can establish itself internationally remains to be seen in view of its further expansion.

AITO sources its battery cells from CATL. A long-term strategic agreement has been in place between the manufacturer Seres and CATL since 2022, according to which AITO models will be equipped with CATL batteries until at least 2027. CATL battery systems such as the Qilin generation will be used, among others. New battery technologies have also been announced for upcoming AITO models, including a sodium-based CATL battery with very high fast-charging capability.

Sources

[1] https://aito.auto/ (Homepage, Access 08.02.2023)

[cs 08.02.2023, 03.06.2023, 02.12.2025]

AI-WAYS is a BEV start-up from China founded founded in Shanghai in 2017, the company has a subsidiary in Munich. The brand primarily offers the U5 and U6 SUV models, which have been in production since 2019 and 2021, respectively, and were also launched in several European markets in 2020.

From 2023 onwards, Aiways came under pressure as the Chinese EV market was characterized by overcapacity and fierce price competition. In 2024, the company officially withdrew from the Chinese market and has since focused exclusively on export markets, particularly Europe. At the same time, a structural realignment was initiated: a merger with the US SPAC Hudson Acquisition created the new company EuroEV Holdings, through which Aiways will operate in the future. Based on this transaction, Aiways was valued at approximately $410 million. In addition, the company plans to start local vehicle production in Europe in 2025 to stabilize supply chains and strengthen market access.

AI-WAYS U5

(Mit freundlicher Genehmigung/Courtesy of Aiways Automobile Europe GmbH [Galerien])

AI-WAYS U6

(Mit freundlicher Genehmigung/Courtesy of Aiways Automobile Europe GmbH [Galerien])

Sales figures in Europe have remained comparatively low in recent years: around 550 vehicles were registered in 2020, around 1,000 in 2021, and around 1,200 in 2022. Despite the low sales levels, Aiways is sticking to its international sales strategy and sees long-term potential in the European market.

Financially, Aiways has raised a total of around 5.2 billion yuan since its founding. The economic situation has been tense recently, but the international realignment, planned production in Europe, and capital structure via EuroEV Holdings are expected to open up new prospects for the company.

Sources

[1] https://www.ai-ways.eu/de/ (Homepage, Access 05.09.2022)

[cs 05.09.2022, 04.06.2023, 02.12.2025]

Aptera is a Californian solar car start-up, that was only founded in 2019 by Chris Anthony and Steve Fambro in San Diego, although the founders had already been involved with electric vehicles before [1].

Aptera, along with Lightyear and Sono Motors, is one of the startups focusing on electric vehicles with solar cells, meaning that some of the electrical energy will be generated directly from the sun.

Aptera Model Gamma

(Mit freundlicher Genehmigung/Courtesy of Aptera Motors Corp. [Homepage])

Configurator Aptera Homepage

(Mit freundlicher Genehmigung/Courtesy of Aptera Motors Corp. [Homepage])

The entry price is $25,900 for the 250-mile (402 km) range version; optional ranges of 400, 600, or even 1000 miles (1609 km) can be configured; for the 1000-mile variant, the base price is $44,900 (see figure above).

The number of solar panels can also be configured, with an additional charge of €900 for the maximum configuration.

Up to 40 miles per day can be charged via the solar cells, which is roughly equivalent to the average daily driving distance in the USA. Especially for sun-drenched and densely populated Southern California, this idea of “driving without recharging” sounds fascinating, of course.

Aptera’s cell supplier is EVE Energy, using 21700 cells (21 mm diameter, 70 mm length) with NMC-811 chemistry (nickel/manganese/cobalt ratio of 8 to 1 to 1) [2].

Overall, the Aptera is a very exciting product, but it remains to be seen whether it will appeal to American consumers.

Sources

[1] https://aptera.us/ (Homepage, Access 13.02.2023)

[2] https://aptera.us/aptera-announces-battery-cell-supplier-eve-energy-co-ltd/ (Homepage, Access 13.02.2023)

[cs 13.02.2022]

ARI 458

(Mit freundlicher Genehmigung/Courtesy of ARI Motors GmbH [Homepage])

The vehicle platforms comes from the Chinese manufacturer Jiauan EV [2].

The cell supplier of Ari Motors or Jiauan EV is not known to the editors.

Sources

[1] https://ari-motors.com/ (Homepage, Access 17.09.2022)

[2] https://de.wikipedia.org/wiki/ARI_Motors (Access 17.09.2022)

[cs 17.09.2022]

English BEV start-up founded in London in 2014 by Denis Sverdlov, but which has since had to be wound up.

Arrival wanted to manufacture electric delivery vans, small trucks, and buses in so-called “microfactories.” Instead of large factories, Arrival wanted many small, robotized locations in order to build electric transporters efficiently and flexibly. However, the concept proved too complex, and production delays, technical problems, massive cost explosions, and the failure to achieve serious series production led to doubts early on.

By 2022, the company was already reporting significant losses; the debut van never went into series production. As a result, capital raising and investor confidence collapsed. In January 2024, trading on the stock exchange was suspended and shortly thereafter the delisting decision was implemented. On May 22, 2024, the group was officially declared bankrupt.

[cs 20.09.2022, 02.12.2025]

Avatr is a Chinese BEV joint-venture established by Changan and Nio in 2018. Changan is a state-owned car manufacturer, which was founded back in 1862 to produce military equipment, among the four major state-owned car companies in China, Changan ranks 4th.

Meanwhile, Nio has withdrawn from the company again, CATL has entered instead. Huawei is assisting with development but does not have a stake in the company. The first model is the AVATR 11, an attractive midsize SUV coupe equipped with CATL’s new cell-to-pack technology. According to the press release, other technical specifications include a 750-volt platform, a range of 680 km according to CLTC, 200 km of range in 10 minutes of charging, and classic NMC cell chemistry.

This was followed by the AVATR 12, 07, and 06. In 2024, Avatr achieved 73,606 deliveries, with further growth expected in 2025, with over 10,000 sales in March alone. Total sales in 2025 are estimated at 130,000 and 150,000 units.

Avatr 11 – Exterieur

(Mit freundlicher Genehmigung/Courtesy of Avatr Technology (Chongqing) Co., LTD. [Homepage])

Avatr 11 – Interieur

(Mit freundlicher Genehmigung/Courtesy of Avatr Technology (Chongqing) Co., LTD. [Homepage])

In its financial results, Avatr reported revenue of RMB 15.35 billion (≈ €1.84 billion) for 2024. Despite this growth, the company posted a net loss of around RMB 4.02 billion (≈ €480 million) in 2024 as it continued to invest heavily in development, brand building, and sales. In the first half of 2025, Avatr already achieved RMB 12.2 billion in revenue (≈ €1.46 billion), of which RMB 11.5 billion came from vehicle sales, but still recorded a small net loss of around RMB 15.9 million (≈ €2 million). The company emphasizes its goal of reaching the break-even point by the end of 2025.

A first step toward international visibility was its appearance at the IAA Mobility 2025 in Munich. There, Avatr presented several production models (including the AVATR 06, 07, and 11). However, the company has not yet provided specific dates for the market launch or first European deliveries.

Sources

[1] https://www.avatr.com/ (Homepage, Access 06.02.2023)

[cs 06.02.2022, 13.09.2023, 04.12.2025]

BeyonCa is a BEV-Start-up founded in 2022 by Renault China CEO Soh Weiming and Dongfeng Motor in China. Company locations include a headquarters in Beijing, a design center in Munich, and an artificial intelligence development site in Singapore.

The name stands for “Beyond Car”, which probably means “more than a car”; the “more” includes medical monitoring functions such as blood pressure measurements, which are to be integrated into the vehicle.

GT Opus 1 – Front

(Mit freundlicher Genehmigung/Courtesy of BeyonCa Information Technology Co., Ltd [Homepage])

GT Opus 1 – Back

(Mit freundlicher Genehmigung/Courtesy of BeyonCa Information Technology Co., Ltd [Homepage])

The first product is a premium sedan called GT Opus 1 with an operating voltage of 800 V and a HV battery with 130 kWh. In terms of gap dimensions, the company wants to follow the lead of German premium manufacturers, which it has also identified as its main competitors. The start of series production was originally planned for 2024, but this date could not be met [2].

There is currently no evidence of acute financial difficulties at BeyonCa, but there is still a lack of information on production, sales, and business figures. It is also striking that the last media entry on the official website dates back to 2024, which suggests reduced public communication. Given the strong consolidation pressure in the Chinese EV market, it cannot be ruled out that BeyonCa is also facing economic challenges, although there has been no official confirmation of this to date.

Sources

[1] http://www.beyonca.com/ (Homepage, Access 13.02.2023)

[2] https://www.auto-motor-und-sport.de/neuheiten/beyonca-gt-opus-1-super-premium-elektroauto/ (Access 13.02.2023)

[cs 06.02.2022, 05.12.2025]

BYD Company Limited (BYD for short) was founded as start-up for the production of battery cells in 1995 by Mr. Wang Chuanfu in the city of Shenzhen, with the abbreviation BYD standing for “Build Your Dream”. BYD also became an automobile manufacturer in 2003 by joining Xian Qinhuan Automobile. Today’s BYD group structure includes various subsidiaries, the most important of which are BYD Auto, BYD Electronics, BYD LED, and BYD Daimler New Technology Company, a joint venture between BYD and Mercedes-Benz AG [1].

The batteries, including the battery cells, are developed and produced by the subsidiary FinDreams. This makes BYD the only automotive manufacturer in the world that develops and produces cells and batteries entirely in-house.

In 2024, BYD sold over 4 million NEVs, making BYD Auto the largest electric car manufacturer in the world. In March 2022, production of pure combustion engines was discontinued, meaning that BYD now focuses on pure electric vehicles (BEVs) and plug-in hybrids (PHEVs).

BYD has gradually refined its hybrid technology. The DM-i drive system was introduced in the early 2020s and combines serial and parallel operation. In everyday use, the combustion engine usually acts as a range extender, while the electric motor does most of the work. At higher speeds, however, the gasoline engine can also intervene mechanically to increase efficiency and performance.

The DM-i hybrid system is now used in numerous models such as the Qin, Song, Tang, Seal U, and other series. The BYD Touring 6 with DM-i drive is now also to be exported to Europe. This drive technology could be particularly attractive in Germany, with its high highway speeds.

In 2024, BYD sold around 4.27 million NEV vehicles worldwide. Of these, around 1.76 million were pure electric vehicles (BEVs) and around 2.49 million were plug-in hybrids (PHEVs). Although this still represented significant growth compared to 2023, developments in 2025 show that the previously rapid acceleration in growth is reaching its limits.

However, BYD has been one of the few profitable BEV start-ups for several years now:

- In the 2023 financial year, the company already achieved a net profit of almost RMB 30.1 billion (≈ €4 billion) on annual sales of RMB 602.3 billion (≈ €79.1 billion).This represents an increase in profit of over 80% compared to the previous year.

- In 2024, BYD continued its growth, with revenue increasing to over RMB 777 billion (≈ €99.3 billion) and profit reaching RMB 40.2 billion (≈ €5.1 billion).

BYD Model Han – Exterieur

(Mit freundlicher Genehmigung/Courtesy of Hedin Electric Mobility GmbH [Homepage])

BYD Model Han – Interieur

(Mit freundlicher Genehmigung/Courtesy of Hedin Electric Mobility GmbH [Homepage])

In 2024, BYD sold around 417,000 vehicles outside China. For 2025, the company aims to increase its overseas sales to over 800,000 units.

The European market is becoming increasingly important for BYD, but sales figures remain low compared to China. In Germany, around 2,900 new BYD vehicles were registered in 2024, representing a decline of around 30 percent compared to the previous year. At the same time, there was a slight upturn in 2025: in April 2025, more than 1,500 vehicles were sold in Germany, which represents a significant increase over the same month last year, but still remains at a low level.

Overall, it should be noted that BYD continues to achieve high sales figures, but the extreme growth path of previous years has noticeably flattened. Sales in China are showing the first signs of fatigue, particularly in the PHEV segment, while export markets are growing but are not yet strong enough to fully offset the slowing momentum in the domestic market.

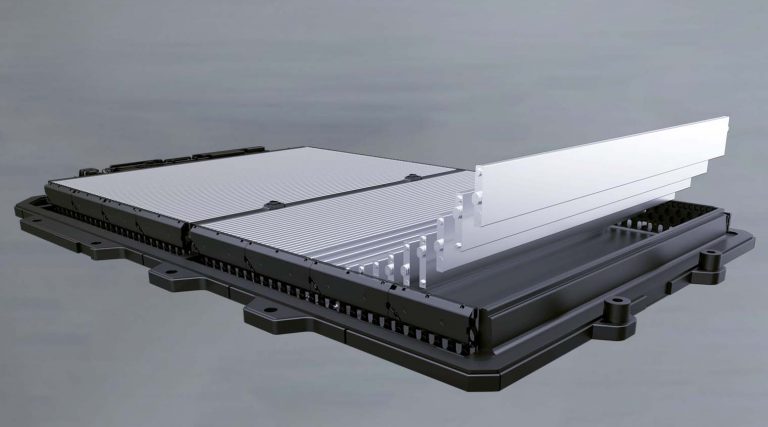

HV battery equipped with blade cells

(Mit freundlicher Genehmigung/Courtesy of BYD Company Ltd. [Homepage])

BYD is currently the only automotive company that develops and produces the lithium-ion cells, the pack and the battery completely in-house. BYD serves all cell formats – cell, pouch and prismatic – and uses the most common cell chemistry variants NMC and LFP.

Blade cells are almost exclusively used in hybrid and electric vehicles. These are prismatic cells with an unusual length of up to almost one meter, which visually resemble a sword blade. The long blade cells are used in BEV models, while short cells are used in BYD’s hybrid vehicles.

The blade cell is only available with lithium iron phosphate (LFP) chemistry, which, unlike NMC chemistry, does not require critical raw materials such as nickel and cobalt and is significantly safer in terms of overheating and fire risk (thermal runaway). An HV battery built from Blade cells is designed to last 1.2 million kilometers or 3,000 charging cycles [2].

The disadvantage of iron phosphate cells compared to NMC cells is the lower energy density. When blade cells are used, this disadvantage is compensated by the very compact design that allows HV batteries to be composed of blade cells.

BYD is listed on the stock exchange, among others in Frankfurt under WKN A0M4W9 and ISIN CNE100000296.

Sources

[1] https://de.wikipedia.org/wiki/BYD (Access 10.10.2022)

[2] https://battery-news.de/index.php/2021/03/16/neue-infos-zur-blade-battery-von-byd (Access 11.10.2022)

[cs 11.10.2022, 08.09.2023, 17.11.2025, 27.12.2025]

The business activity of Byton was already discontinued in 2021.

Byton was a Chinese BEV start-Up founded in 2017 by former BMW and Nissan managers in Honk-Kong, the first vehicle prototype was presented in 2018. Production of the first model, M-Byte, was scheduled to start in 2019, but was delayed several times due to financial difficulties.

In 2021, Byton was insolvent, and Byton has since ceased operations completely [1].

Sources

[1] https://en.wikipedia.org/wiki/Byton_(company) (Access 27.10.2022)

[cs 27.10.2022]

Canoo’s business model, which was based on a platform concept, proved to be unsustainable. In January 2025, due to insufficient sales, the company filed for Chapter 7 bankruptcy, followed by liquidation.

Canoo was founded in 2017 under the name Evelozcity and was a US manufacturer of battery electric vehicles, most recently based in Bentonville, Arkansas. The company addressed the market segment for commercial and delivery vehicles as well as vans based on a modular multi-purpose platform (MPP) that combined the battery, drive, and control technology in a flat skateboard concept.

BEV platform from CANOO

(Mit freundlicher Genehmigung/Courtesy of Canoo Technologies Inc. [Press Release])

Van based on CANOO platform

(Mit freundlicher Genehmigung/Courtesy of Canoo Technologies Inc. [Press Release])

In 2023, only around 22 vehicles were delivered, which was also reflected in very low annual sales of around US$886,000. The company had originally forecast sales of between $50 million and $100 million for 2024, but in fact only achieved a very low single-digit million amount; at the same time, deliveries remained extremely low at less than a dozen vehicles.

[cs 16.10.2022, 18.02.2023, 05.12.2025]

Ceer is a New-Country start-up new-country start-up from Saudi Arabia and also the first Saudi Arabian car brand [1]. The company was founded at the end of 2022 as a joint venture between the state-owned Public Investment Fund (PIF) and Taiwanese electronics manufacturer Foxconn. The brand is positioning itself as a pioneer of a new Saudi automotive industry as part of Vision 2030 and plans to offer battery-electric vehicles – including sedans and SUVs – for the domestic market, the Gulf region, and the wider Middle East.

Ceer is building a production facility in King Abdullah Economic City (KAEC) near Jeddah; the site is expected to cover more than one million square meters. The contract for the plant has been awarded, and construction began in early 2023.

International technology partnerships are an integral part of the concept: Ceer uses licensed components from German manufacturer BMW and drive systems from Croatian start-up Rimac Technology. The company has also signed a supply contract with Hyundai Transys for e-drive systems for the electric platform. Foxconn is responsible for the electronic architecture, infotainment, and connectivity. The first series delivery was originally scheduled for 2025, but this has since been postponed to 2026 [2].

Technologically, Ceer is a very ambitious project, but it has extremely financially strong investors.

Sources

[1] https://ceermotors.com/ (Homepage, Access 14.02.2023)

[2] https://ceermotors.com/news/ceer-to-establish-electric-vehicle-manufacturing-site-at-king-abdullah-economic-city/ (Access 14.02.2023)

[cs 14.02.2023, 06.12.2025]

Cenntro is a U.S. startup based in New Jersey for small and medium-sized battery–electric VANs that can be used primarily for inner-city logistics. In 2021, a merger with Naked Brand Group took place.

In 2022, Cenntro acquired a majority stake in Tropos, a company based in Herne, Germany, which is active in the same market segment..

Cenntro Mini-Van Metro

(Mit freundlicher Genehmigung/Courtesy of Cenntro Electric Group Limited [Homepage])

Cenntro’s first product is the Metro van, of which more than 3300 units have been produced since 2017; target markets are Europe, the USA, Japan, Korea, Singapore and Israel. The product range has now grown significantly, and Cenntro now covers payloads from 500 kg (Logistar 100 model) to 3500 kg (Logistar 400 model).

LFP cells are used in the HV battery, although classic lithium-ion cells with NMC chemistry are still installed in the Metro. The cell supplier of Cenntro of the editorial office is not known.

A separate subsidiary for battery production was established in August 2022, the production site is Monterrey in Mexico, and production is scheduled to start in 2023.

Since the merger with Naked Brand Group, Cenntro is listed on Nasdaq (ISIN AU0000198582, WKN A3DAKM) [1].

Sources

[1] https://ir.cenntroauto.com/ (Access 15.02.2023)

[cs 16.10.2022,, 15.02.2023]

Car manufacturer with cult status, as the only internal combustion model with gullwing doors produced only between 1981 and 1982 played a leading role in the Hollywood trilogy “Back to the Future“. In business terms, the company was a flop; demand collapsed relatively quickly after massive quality problems.

However, the few vehicles still on the road today are always a crowd puller at classic car events.

Delorean model ALPHA5

(Mit freundlicher Genehmigung/Courtesy of DeLorean Motors Reimagined LLC [Homepage])

A BEV start-Up is now venturing a new edition as a BEV model called ALPHA5, which is also set to feature the iconic gullwing doors. However, many details remain unclear: neither the price nor the start of series production have been specified, and there are doubts as to whether the ambitious plans announced are realistic.

It therefore remains to be seen whether this cult brand’s second attempt will be more successful.

Sources

[1] https://delorean.com/ (Homepage, Access 19.10.2022)

[cs 19.10.2022, 12.12.2025]

Evergrande New Energy Auto [↑] [↓] [⇑] [⇓]

Evergrande is one of the largest Chinese real estate companies, which has made the headlines due to its debt crisis [1]. With the new business division and the new BEV brand Evergrande New Energy Auto, the company wanted to tap into new sources of revenue.

The goals communicated by Evergrande sounded extremely ambitious. By 2025, production was to be ramped up to one million electric vehicles per year, and by 2035, five million electric vehicles were planned [2]. The company started production of the model Hengchi 5 in September 2022, with deliveries scheduled to begin in October; the Hengchi 6 and 7 were to follow successively in 2023.

However, developments did not go as hoped: production of the Hengchi 5 was discontinued at the end of 2022 due to lack of demand. In the years that followed, the economic situation deteriorated dramatically. In the summer of 2024, a Chinese court ordered the bankruptcy of two subsidiaries of the EV division.

Despite the tense situation, the bankruptcy administrators have been actively seeking to sell shares in the company since 2024: a preliminary agreement was in place with a potential investor. However, by early 2025, it became apparent that no binding strategic buyer had been found. Although offers are still being reviewed, a secure rescue deal seems highly unlikely.

Evergrande New Energy Auto is listed on the stock exchange, including in Frankfurt (ISIN HK0000264595, WKN A14Y51); however, trading has been suspended.

Sources

[1] https://www.faz.net/aktuell/finanzen/staat-eilt-krisenkonzern-china-evergrande-zu-hilfe-17748055.html (Access 27.10.2022)

[2] https://mobilesite.evergrande.com/en/business.aspx?tags=6 (Homepage, Access 27.10.2022)

[cs 27.10.2022, 21.02.2023, 07.12.2025]

EVUM Motors GmbH is a spin-off of the Technical University of Munich and is developing a compact, electrically powered small van with all-wheel drive under the name EVUM aCar. The company is currently under compulsory administration by an insolvency administrator.

Since its founding in 2017, the company has pursued the goal of bringing the aCar, a robust, simple, and flexible electric commercial vehicle for agriculture, trade, municipalities, and transport, to market. After switching to series production, the first vehicles were delivered in the summer of 2021; production took place at the Bayerbach site near Ergoldsbach.

The aCar concept is based on a simple, cost-conscious design with a 48-volt drive, which allows the vehicle to be charged from a standard 230-volt outlet and provides a range of up to 200 km and a payload of up to 1000 kg. EVUM Motors thus targeted customers looking for an affordable, versatile, and low-maintenance transport vehicle — originally with an eye on emerging markets and rural regions, but later also with a focus on Europe.

EVUM aCar

(Mit freundlicher Genehmigung/Courtesy of Evum Motors GmbH [Download Area])

Despite multiple rounds of financing and support from investors and institutional funding, EVUM Motors appeared to be struggling with significant economic problems. On April 30, 2025, the competent Munich District Court ordered provisional insolvency administration of the assets of EVUM Motors GmbH; an insolvency administrator was appointed. Business operations involving development and production are to be continued, at least for the time being.

This means that EVUM Motors is currently no longer in a position to pursue its original corporate goals. It remains to be seen whether restructuring or the entry of investors will be successful.

Sources

[1] https://evum-motors.com/ (Access 18.02.2023)

[cs 18.02.2023, 07.12.2025]

Faraday Future [↑] [↓] [⇑] [⇓]

Faraday Future was founded in 2014 in California as a BEV start-up, being a joint American-Chinese project. The company has locations in Los Angeles (headquarters and R&D center), Silicon Valley, and China (Beijing, Shanghai, and Chengdu) [1].

The first model is a luxury SUV called FF91, which the company says will compete with premium brands such as Bentley, Ferrari, Maybach, and Rolls-Royce. The few known technical specifications include an output of 1050 hp, acceleration from 0 to 100 km/h in 2.3 s, and a range of about 600 km.

In reality, however, economic success has failed to materialize: according to available data, Faraday Future had brought only a very small number of electric vehicles to market by mid-2025. Officially, not even 20 vehicles had been sold in eleven years. Production thus barely exceeded small series. There have been repeated reports of significant financing problems that have been weighing on the company for years.

Faraday Future model FF91

(Mit freundlicher Genehmigung/Courtesy of Faraday&Future Inc. [Press Room])

Interieur F91

(Mit freundlicher Genehmigung/Courtesy of Faraday&Future Inc. [Press Room])

Most recently, Faraday Future reported an operating loss of approximately $27.4 million for the second quarter of 2025 and a monthly cash burn rate of approximately $9 million. Although cash reserves temporarily reached an 18-month high, this improvement cannot hide the fact that the business model is characterized by uncertainty.

As a result of ongoing problems, Faraday Future is attempting to counteract these with alternative strategies, including restructuring, partnerships, and diversification of the company’s activities. Whether these measures will be sufficient to stabilize the company in the long term and achieve its original goals remains to be seen.

Sources

[1] https://www.ff.com/(Homepage, Access 18.02.2023)

[cs 27.10.2022, 07.12.2025]

The Fisker Inc. filed for bankruptcy in June 2024, liquidation was confirmed by the court in fall 2024, and the company was subsequently wound up completely. Production, sales, and all planned model series were discontinued, and the brand no longer exists operationally. Remaining assets are merely being liquidated, and there are currently no plans to continue the company.

Back in 2007, former BMW designer Hendrik Fisker had already founded a BEV start-up under a similar name. The first model was a plug-in hybrid that was unveiled at the Detroit Auto Show in 2008. Due in part to the bankruptcy of cell supplier A123, production had to be discontinued again in 2012 and the assets were sold to a Chinese group of companies.

In 2016, the company was re-established under the name Fisker Inc., but now with a focus on battery electric vehicles (BEVs). The first model was an SUV called Ocean, which can be optionally equipped with solar cells on the roof. The Fisker Ocean electric SUV was the first series-production vehicle to be offered, manufactured by contract manufacturer Magna Steyr in Graz. At the same time, Fisker planned further models such as the compact crossover SUV Fisker Pear and the Fisker Alaska pickup truck.

Fisker Ocean – Exterieur

(Mit freundlicher Genehmigung/Courtesy of Fisker, Inc.. [Press Gallery])

Fisker Ocean – Interieur

(Mit freundlicher Genehmigung/Courtesy of Fisker, Inc.. [Press Gallery])

However, the economic reality was disappointing, with financial difficulties already apparent by the end of 2023. In March 2024, the company announced that it would not be viable without fresh capital.

Parallel to these developments, the Ocean suffered from technical problems and several recalls — further undermining confidence among customers and suppliers. The ambitious expansion plans with Pear and Alaska came to a standstill: production of the Ocean was discontinued and the future of the brand projects is currently uncertain.

Talks with potential partners, including an automobile manufacturer, were unsuccessful, and trading in the company’s shares was soon suspended and its stock market listing revoked. In June 2024, Fisker finally filed for creditor protection under US bankruptcy law (Chapter 11).

Sources

[1] https://www.fiskerinc.com/ (Homepage, Access 21.02.2023)

[cs 21.02.2023, 07.12.2025]

GAC Aion was established in July 2017 as a new BEV brand of GAC Group (Guangzhou Automobile Group Co., Ltd.) focusing on innovative battery electric vehicles. GAC Group is a state-owned enterprise from 1954, currently it is the fifth largest Chinese automaker of internal combustion engine vehicles [1].

GAC Aion, a new BEV brand from a combustion engine manufacturer, got off to a very successful start, selling more than 270,000 vehicles in China in 2022 [2]. This was significantly more than the BEV start-ups NIO and Xpeng, which are much better known in Germany.

GAC Aion continued its growth in 2023, with the brand achieving a production/delivery volume of around 480,000 vehicles, making it one of the largest pure electric brands in China.

However, in 2024, the number fell to around 375,000 vehicles, indicating market changes and growing competition in China. There are clear signs of a further decline in 2025: in May, Aion reported 26,777 NEV deliveries, which represented a sharp decline compared to the previous year. Assuming that the rest of 2025 follows a similar pattern to the first seven months, GAC Aion could end the year with roughly 220,000 – 240,000 vehicles.

GAC Aion Hyper GT – Exterieur

(Mit freundlicher Genehmigung/Courtesy of GAC Aion New Energy Automobile Co., Ltd. [Press Gallery])

GAC Aion Hyper GT – Interieur

(Mit freundlicher Genehmigung/Courtesy of GAC Aion New Energy Automobile Co., Ltd. [Homepage])

Models on offer include classic sedans (AION S, AION S Plus) and SUVs (AION LX Plus, AION V Plus, AION Y Plus). AION attracted particular attention with the Hyper GT, a four-door super sports car with a drag coefficient of 0.19 cW; production and sales are scheduled to start in 2023. No export to Europe is known [4].

Parallel to production in its home market of China, GAC Aion prepared for its market entry in Europe in 2025: The official launch for the European market was announced at IAA Mobility 2025 with the Aion V model, with deliveries initially to Poland, Portugal, and Finland, among other countries. In addition, assembly of Aion V SUVs began in December 2025 with partner Magna at the plant in Graz, Austria — a step with which GAC aims to avoid customs duties and drive forward its European expansion.

GAC Aion primarily sources its lithium-ion batteries from CALB, CATL und Farasis Energy, with CALB accounting for over 70% of the total. In newer models such as the Aion UT Super, GAC Aion is increasingly relying on CATL batteries, including CATL’s “Choco-SEB” swapping technology.

The parent company GAC Motor is listed on the stock exchange (ISIN CNE100000Q35, WKN A1C2W3).

Sources

[1] https://www.gac.com.cn/en/brand (Access 22.02.2023)

[cs 22.02.2023, 08.12.2025]

Hozon Auto (Neta) [↑] [↓] [⇑] [⇓]

The Chinese BEV Start-up Hozon Auto filed for bankruptcy in June 2025.

The company was founded in 2014 in Zhejiang Province, south of Shanghai [1]; in addition, a research center for autonomous driving was opened in Silicon Valley in 2018 and a design center in Beijing in 2019 [2][3]. Since November 2021, cell and battery manufacturer CATL has held a stake in the subsidiary Neta Auto [4].

The products were sold in China under the Neta brand. The Neta V model ranked ninth on the list of the world’s best-selling electric cars in 2022 with around 94,400 vehicles sold.

Sales increased to 127,500 units in 2023, however sales figures declined significantly in subsequent years. In 2024, deliveries fell to just under 87,500 vehicles in 2024. At the same time, Neta recorded around 30,000 vehicles sold or exported abroad in 2024, and its sales partner network was expanded to 184 channels worldwide. The company announced its intention to significantly expand its export activities in 2025.

Hozon Auto Neta U2 – Exterieur

(Mit freundlicher Genehmigung/Courtesy of Hozon New Energy Automobile Co.,Ltd.. [Press Gallery])

Hozon Auto Neta U2 – Interieur

(Mit freundlicher Genehmigung/Courtesy of Hozon New Energy Automobile Co.,Ltd.. [Press Gallery])

However, as a result of declining sales in its domestic market, Hozon Auto’s economic situation has deteriorated dramatically: in 2023, the company reported revenue of RMB 13.554 billion (~€1.65 billion) and a net loss of RMB 6.758 billion (~€0.84 billion). Total assets were reported at RMB 21.366 billion (~€2.6 billion).

In January 2025, new registrations slumped sharply compared to the previous year, with fewer than 400 vehicles sold in February 2025. Accordingly, Hozon Auto filed for bankruptcy in June 2025.

Sources

[1] https://carnewschina.com/2017/04/28/hozon-auto-another-new-ev-brand-china (Access 24.03.2023)

[2] https://www.futurecar.com/2163/HOZON-Auto-Launches-R&D-Center-in-Silicon-Valley-to-Explore-Autonomous-Driving (Access 24.02.2023)

[3] http://www.chinadaily.com.cn/a/201904/01/WS5ca18428a3104842260b3ad3.html (Access 24.02.2023)

[4] https://www.electrive.net/2021/11/15/catl-beteiligt-sich-an-e-auto-marke-neta (Access 24.02.2023)

[cs 24.02.2023, 13.09.2023, 08.12.2025]

Human Horizons [↑] [↓] [⇑] [⇓]

The Chinese BEV start-up Human Horizons has been in formal insolvency proceedings or judicial restructuring since mid-2024 after the company was no longer able to meet its financial obligations.

Human Horizons was founded in Shanghai in 2017 by former GM China manager Ding Lei [1]. The company operated a production and assembly plant in Yancheng (Jiangsu) and a parts factory in Jinqiao, Shanghai. The HiPhi brand was launched in 2019.

In its early years, HiPhi positioned itself in the high-priced premium electric vehicle segment. The HiPhi X was the first production model, followed by the sporty HiPhi Z and the more affordable HiPhi Y, which was introduced in 2023. Despite technologically sophisticated products, the economic situation deteriorated significantly from 2023 onwards.

Only 226 HiPhi X vehicles were registered in 2023, and only 33 units in 2024; there are no reliable figures available for the HiPhi Y, but due to the production stoppage, similarly low volumes can be assumed. From 2025 onwards, there will be virtually no sales, as all operations will have been discontinued beforehand. Even the export plans to Europe, which began in 2023 with showrooms in Munich and Oslo, did not result in any verifiable sales volumes.

HiPHi X from Human Horizons

(Mit freundlicher Genehmigung/Courtesy of Human Horizons (Shanghai) Connectivity Technology Co., Ltd. [Media Center])

HiPHi Z from Human Horizons

(Mit freundlicher Genehmigung/Courtesy of Human Horizons (Shanghai) Connectivity Technology Co., Ltd. [Media Center])

In 2025, an attempt was made to reposition the HiPhi brand. Despite these measures, the company’s future remains uncertain, as the Chinese market is characterized by intense competition and a sharp decline in prices, and the brand has suffered a significant loss of confidence due to the production stoppage and bankruptcy.

Sources

[1] https://www.bloomberg.com/news/videos/2018-11-23/human-horizons-founder-ding-lei-on-tesla-video (Access 27.02.2023)

[cs 27.02.2023, 13.09.2023, 12.12.2025]

Hycan was a new new BEV brand launched in 2018 as a joint venture between GAC and NIO. Due to a lack of commercial success, business operations have now been suspended and, according to GAC Group, customer service has been wound up in an orderly manner.

GAC stands for Guangzhou Automobile Group, which is the fifth-largest Chinese manufacturer of combustion engine vehicles. It was founded in 1954 as a state-owned enterprise. NIO had withdrawn from the joint venture, meaning that Hycan was a GAC-only brand [1].

Sales of the first vehicles began in China in 2020. The models include the electric crossover Hycan 007, the compact model Z03, the mid-size sedan A06, and, since the end of 2023, the spacious MPV Hycan V09 [2].

Hycan has already experienced significant sales difficulties in recent years. Total sales for 2023 are reported to be only 18,559 vehicles, which is already a decline compared to 2022. Sales remained low in 2024; quarterly and monthly data and reports indicate that fewer than 20,000 units were sold in 2024.

Hycan 007 – Exterieur

(Mit freundlicher Genehmigung/Courtesy of Hechuang Automotive Technology Co., Ltd. [Homepage])

Hycan 007 – Interieur

(Mit freundlicher Genehmigung/Courtesy of Hechuang Automotive Technology Co., Ltd. [Homepage])

There are no reliable overall sales figures for 2025 available yet; individual monthly figures (e.g., September 2025) show only a few dozen units for V09, and figures for 2024 or 2025 on revenue, assets, and profit/loss are not publicly available.

According to the current public presentation, Hycan is “substantially defunct,” meaning that its operational business is dormant and the brand no longer exists de facto. According to the GAC Group, the takeover of customer service and the remaining structure was dissolved in an orderly manner.

Sources

[1] https://autonews.gasgoo.com/china_news/70021139.html (Access 07.06.2023)

[4] https://www.hycan.com.cn/ (Zugriff 26.05.2023)

[cs 26.05.2023, 07.06.2023, 12.12.2025]

IM Motors is a very young BEV joint-venture founded in January 2021 as a collaboration between SAIC Motors and Alibaba; the company targets the premium segment of Chinese electric vehicles [1][2]. Similar to Afeela and Aito, IM Motors is about combining the expertise of a traditional combustion engine manufacturer with an electronics group.

In 2024, CATL acquired a stake in IM Motors as part of a capital increase.

SAIC Motor itself (Shanghai Automotive Industry Corporation) is China’s largest automotive group; the company is state-controlled and sold around 4.740 million vehicles worldwide in 2024. In addition to its own brands, SAIC also produces vehicles for Western manufacturers, including VW and GM, as part of joint ventures.

The ADP (Advanced Digitized Platform) electric platform, jointly developed by SAIC and IM, is already being used by Audi for the new China-exclusive “AUDI” brand, which deliberately dispenses with the traditional four-ring logo. The first model of this brand had a successful launch in 2025 with over 10,000 pre-orders.

IM Motors has been offering its own production-ready vehicles since 2022 and will expand its market presence with SUVs and sedans starting in 2023. Sales figures show growth, but at a still low level. 38,250 vehicles were reported for 2023, and the number rose to 65,500 units for 2024.

No reliable total sales figures are available for 2025 as yet.

IM Motors LS7 IM – Exterieur

(Mit freundlicher Genehmigung/Courtesy of Zhiji Automobile Technology Co., Ltd. [Homepage])

IM Motors LS7 IM – Interieur

(Mit freundlicher Genehmigung/Courtesy of Zhiji Automobile Technology Co., Ltd. [Homepage])

In 2025, the portfolio was expanded with the introduction of the large IM LS9 SUV with range extender drive and a combined range of up to 1,500 km (with a 66 kWh battery). The LS9 is positioned as the brand’s new premium flagship.

No reliable data is available on exports to Europe or detailed sales figures outside China, which means that IM Motors appears to continue to focus on its home market in China.

CATL is named as the cell manufacturer for the batteries in IM models, including the battery in the new LS9.

Sources

[1] https://equalocean.com/company/zhijiqiche (Access 27.02.2023)

[2] https://www.immotors.com/ (Homepage, Access 27.02.2023)

[cs 27.02.2023, 04.06.2023, 01.08.2023, 12.12.2025]

Ineos Automotive [↑] [↓] [⇑] [⇓]

Ineos Automotive is a classic start-up, founded in 2018 in response to the discontinuation of the Land Rover Defender by Jim Ratcliffe, founder and CEO of the chemical company Ineos. Ratcliffe is an experienced adventurer who regularly undertakes challenging global expeditions in off-road vehicles, which explains the company’s focus on robust off-road models.

Together with Magna, a robust combustion engine off-road vehicle called the Grenadier was developed, which has been produced at the former Smart plant in Hambach, France, since 2022. Many components of the Grenadier, such as the engines, come from BMW.

The model range was later expanded to include the Grenadier Quartermaster pickup truck, while the Fusilier electric SUV, originally planned for 2026, was discontinued in 2024 due to economic and structural difficulties.

Ineos Grenadier

(Mit freundlicher Genehmigung/Courtesy of INEOS Capital Limited [Homepage])

The following months saw considerable operational pressures: production interruptions due to insolvent suppliers, a major recall of over 7,000 Grenadier vehicles in the US, rising costs, and a challenging market led to financial bottlenecks and extensive job cuts in 2025.

Although no official insolvency was announced, the restructuring measures and withdrawal from electric vehicle development indicate a clear crisis situation.

Sources

[1] https://www.ineos.com/businesses/ineos-automotive/ (Access 02.05.2023)

[cs 02.05.2023, 12.12.2025]

Izera is the BEV brand of a Polish New-Country start-up founded in 2016 by the state-owned consortium ElectroMobility Poland (EMP) [1]. According to the state supervisory authority, the project had suffered significant delays by 2023, prompting the Polish government to halt the project at the end of 2024 and dissolve the Izera brand. This brought an end to the ambitious plan to establish an independent Polish electric car for the mass market.

In 2020, the first two fully electric models were unveiled, a hatchback sedan and an SUV, with the aim of going into series production in 2023. The vehicles were designed by the Italian firm Torino Design, which brought on board experienced designers such as the former Jaguar designer. The plan was to build a factory in Jaworzno in the Silesian Voivodeship, which would have created around 3,000 jobs.

Izera hatchback model – Exterieur

(Mit freundlicher Genehmigung/Courtesy of ElectroMobility Poland S.A. [For Media])

Izera hatchback model – Interieur

(Mit freundlicher Genehmigung/Courtesy of ElectroMobility Poland S.A. [Homepage])

The vehicles were to be offered with two battery variants (40 and 60 kWh), with a target range of around 400 km. The platform, batteries, and electric motors were to be purchased externally for the most part, with the aim of producing around 60 percent of the parts in Poland itself.

In November 2022, there was a press release regarding the licensing of the Sustainable Experience Architecture (SEA) from the Chinese Geely Group, which would have required a revision of the previous development models.

In 2023, however, it became apparent that the project had achieved only a fraction of its original goals. According to the balance sheet of the responsible state control authority, the project had achieved only about four percent of its planned milestones at that point. In December 2024, the Polish government decided to discontinue the project and dissolve the Izera brand.

Sources

[3] https://izera.com/ (Homepage, Access 28.02.2023)

[cs 28.02.2023, 13.12.2025]

Leapmotor is a BEV start-up founded in 2015 in the Chinese city of Hangzhou. In 2018, the announcement about the first artificial intelligence chip “Lingxin 01” developed in China, which is specifically designed for autonomous driving as well as other deep learning-based systems, attracted attention [1].

In October 2023, Stellantis made a strategic investment in Leapmotor, acquiring around 20% of the company’s shares for around €1.5 billion. This was followed in May 2024 by the establishment of a joint venture with the aim of expanding exports outside China. Sales began in nine European countries in September 2024 and have been gradually expanded since then.

In 2025, it was announced that FAW would also like to acquire a financial stake in Leapmotor, in addition to Stellantis. FAW itself is the second or third largest state-owned car manufacturer in China, depending on the ranking – sales vs. sales figures. FAW plans to acquire a minority stake of around 5% in Leapmotor, following in the footsteps of its competitors SAIC and Changan, which already cooperate with other Chinese BEV start-ups.

Leapmotor sold ~111,000 vehicles in 2022, with deliveries rising to around 144,000 vehicles in 2023. Leapmotor reported deliveries of around 293,724 vehicles for 2024, with a target of around 500,000 units for 2025 as a whole.

This puts Leapmotor roughly on par with NIO in terms of deliveries in 2025, but ahead of Xpeng, which is estimated to sell around 400,000 units in 2025.

Like many other BEV startups, Leapmotor is not yet profitable, but is making significant progress toward that goal:

- In 2023, Leapmotor generated revenue of around RMB 16.7 billion (≈ €2.3 billion) and reported a net loss of RMB 4.57 billion (≈ €0.6 billion).

- In 2024, revenue rose to just under RMB 32.2 billion (≈ €4.4 billion), while the net loss was reduced to RMB 2.8 billion (≈ €0.37 billion).

- In the first half of 2025, Leapmotor achieved revenue of just under RMB 24.3 billion (≈ €3.3 billion) with a half-year net profit of around RMB 30 billion (≈ €4 million), marking its first half-year profitability.

Leapmotor C0I – Exterieur

(Mit freundlicher Genehmigung/Courtesy of Zhejiang Leapmotor Technology Co.,Ltd [News Room])

Leapmotor C0I – Interieur

(Mit freundlicher Genehmigung/Courtesy of Zhejiang Leapmotor Technology Co.,Ltd [Homepage])

Leapmotor’s models now include several series: the 4-door compact model T03, the 2-door sports coupe S01, the mid-size SUV C11, and the mid-size sedan C01. Since 2024, the globally oriented C10 has been added to the portfolio – a mid-size SUV that is the first model to be developed specifically for international markets.

The Leapmotor C10 is available as both a pure electric SUV (BEV) and a plug-in hybrid with a range extender (REEV). This is Leapmotor’s response to the huge success of Li Auto with its range extender models. The C10 is not only sold in China, but is now also available throughout Europe—including through dealer networks associated with Stellantis, i.e., also for markets such as Germany, France, Spain, and other European countries.

Leapmotor was once again represented at the IAA Mobility 2025 in Munich, where it presented the global world premiere of the compact Leapmotor B05 model and the European sales launch of the Leapmotor B10.

According to reports, approximately 13,450 vehicles were sold in 11 European countries by the end of September 2025. Assuming that sales in the last three months (October–December) remain at least at the level of the previous months, Leapmotor could sell between 16,000 and 20,000 vehicles in total in Europe in 2025.

According to well-known sources, the T03 uses LFP (lithium iron phosphate) cells from three different suppliers: CATL, Gotion und SVOLT Energy.

CATL is explicitly mentioned for exported European versions. In models with the cell-to-chassis (CTC) concept, especially the C01, the battery housing is structurally integrated into the bodywork – however, the specific cell supplier is not disclosed. In addition, Leapmotor has started producing its own battery packs through its subsidiary Lingxiao Energy; the cells used for this come from CATL and other suppliers, among others.

Leapmotor is listed in China (ISIN CNE100005K77).

Sources

[1] https://www.leapmotor.net/ (Access 25.11.2025)

[2] https://autonews.gasgoo.com/china_news/70014765.html (Access 28.02.2023)

[cs 27.10.2022, 13.09.2023, 25.11.2025]

Lightyear is a Dutch solar car start-up that emerged from a student initiative at Eindhoven University of Technology, which participated in various solar vehicle competitions.

Based on the project experience, Lightyear – similar to Aptera and Sono Motors – wanted to develop an electric vehicle with solar panels that would generate part of the energy required for driving directly from the sun. This model, called Lightyear 0, was originally intended to be sold for €250,000, but after producing a few vehicles, Lightyear had to file for bankruptcy in January 2023 due to lack of demand [1].

Lightyear 02

(Mit freundlicher Genehmigung/Courtesy of Atlas Technologies B.V. [Press Area])

As a result of its insolvency, Lightyear changed its business model. Instead of building its own solar cars, the company is now focusing on developing and supplying solar panels for vehicles from other manufacturers. At the same time, there was a change in management in the hope that the company’s expertise in solar technology would enable it to operate more successfully in the market.

It remains to be seen whether this change in strategy will be successful in the long term.

Sources

[1] https://lightyear.one/ (Homepage, Access 02.03.2023)

[cs 02.03.2023, 13.12.2025]

Li Auto is a Chinese electric vehicle Start-up start-up founded in 2015 by Li Xiang, whose investors include ByteDance, a company made famous by TikTik.

Li Auto is one of the few companies that have so far exclusively produced so-called range extender models. The vehicles have an internal combustion engine on board, which is only used as an electricity generator. Unlike a parallel hybrid, there is no mechanical coupling of the combustion engine to the drive wheels [1].

Four SUV models have been developed so far, designated Li L7, Li L8, Li L9, and Li One, and marketed primarily as family vehicles. At 5 m long, the L7 is already slightly larger than a BMW X5, while the L9, at 5.22 m, towers over the X7 by several centimeters. In all models, the combustion engine for range extension is located in the rear of the vehicle.

Sales rose from around 32,500 vehicles in 2020 to over 133,000 units in 2022. This year, Li Auto surpassed its competitors NIO and Xpeng in annual delivery figures for the first time, establishing itself among the highest-volume Chinese NEV manufacturers.

Growth continued in 2023, when Li Auto delivered 376,030 vehicles. In 2024, the company reached 500,508 deliveries, an increase of around 33% over the previous year. Analysts currently estimate around 700,000 vehicles for 2025, which already indicates a slowdown in the previously rapid pace of growth. The challenge lies in increasingly intense competition, rising price pressure, and a general flattening of growth in the Chinese market.

However, Li Auto is one of the few BEV start-ups that is already profitable. The company achieved a net profit of RMB 11.8 billion (€1.54 billion) in 2023 and continued its profitable development in 2024, reporting a profit of RMB 3.5 billion (€450 million) in the fourth quarter. However, after several years of stable earnings growth, the third quarter of 2025 saw a significant decline in deliveries, which led to a loss. This amounted to RMB 359.7 million (€44 million).

Li L9 – Exterieur

(Mit freundlicher Genehmigung/Courtesy of Li Auto Inc. [Homepage])

Li L9 – Interieur

(Mit freundlicher Genehmigung/Courtesy of Li Auto Inc. [Homepage])

In addition to its range extender models, Li Auto has also entered the development and production of battery electric vehicles. The flagship BEV “Mega” and the models in the new i series (e.g., i8 and i6) use 800 V technology and large battery packs and are intended to broaden Li Auto’s long-term positioning. In 2024, Li Auto Inc. delivered around 10,800 BEV models, and an increase to around 120,000–150,000 pure electric vehicles is expected for 2025.

Li Auto sources its battery cells primarily from CATL. In addition, Li Auto established a 50:50 joint venture with Sunwoda in 2025 to develop and produce its own lithium-ion batteries.

In terms of export strategy, the focus remains clearly on the Chinese domestic market. Official exports on a larger scale to Europe or the US have not yet started; so far, there have mainly been parallel exports. Although Li Auto is slowly expanding its international presence – including an R&D center in Munich – a full-fledged market launch in Europe is still pending.

Li Motor is listed on the stock exchange, including Frankfurt (ISIN KYG5479M1050, WKN A2QACD).

Sources

[1] https://ir.lixiang.com/ (Homepage, Access 22.04.2023)

[cs 22.04.2023, 21.11.2025]

Liux is a Spanish BEV start-up founded in 2021 by David Sancho Domingo and Antonio Espinosa de los Monteros in Madrid [1]. The choice of name does not seem very fortunate, as it is close to a very popular operating system, which makes searching the Internet much more difficult.

Investors include the leasing provider OK Mobility and the Spanish Ministry of Industry, and further rounds of financing are required to implement series production [2].

Liux prototype Animal

(Mit freundlicher Genehmigung/Courtesy of NATURAL MOVEMENT, S.L. [Press Gallery])

Liux prototype Gecko

(Mit freundlicher Genehmigung/Courtesy of NATURAL MOVEMENT, S.L. [Press Gallery])

The first prototype presented was the Animal model, a crossover between an SUV and a station wagon. Liux is now focusing on a 2-seater city vehicle called Gecko, which externally resembles the 1st generation Smart.

Liux emphasizes that particularly many components of the Animal will be made from renewable natural resins and natural fibers. The number of components is to be reduced by 25% compared with comparative vehicles.

Despite ambitious plans, Liux continues to face significant challenges. Although OK Ventures, the venture capital arm of the OK Group, came on board as the main investor in August 2024, providing fresh capital and strategic support, it remains unclear when series production will actually start.

At this point in time, it is therefore not clear whether Liux will be able to achieve the financial and production base necessary for economically viable production and market entry.

Sources

[1] https://www.liux.eco/ (Homepage, Access 02.03.2023)

[2] https://www.auto-motor-und-sport.de/verkehr/liux-animal-nachhaltige-e-autos-ab-2023 (Access 02.03.2023)

[cs 02.03.2023, 13.12.2025]

Lordstown Motors [↑] [↓] [⇑] [⇓]

Lordstown Motors is a BEV start-up that had to file for bankruptcy in June 2023; the company has already been dissolved.

Lordstown Motors was founded in 2018 by Steve Burns [1]. The following year, the company acquired the former GM plant in Lordsdown, Michigan, from General Motors. Due to financial difficulties, the plant was sold to Taiwanese contract manufacturer Foxconn for $230 million in November 2021 [2]. In November 2022, Foxconn invested another $170 million in Lordstown Motors [3].

Lordstown Motors had developed a typical American light truck called Endurance with a length of 5.8 m. The technical highlight of this model was that all four wheels were driven by a so-called wheel hub motor. The motor was located in the wheel hub directly on the tire, which significantly reduced the complexity of the powertrain components, as components such as drive shafts and differential gears were no longer necessary.

Endurance from Lordstown Motors – Front

(Mit freundlicher Genehmigung/Courtesy of Lordstown Motors Corp. [Media Page])

Endurance fromLordstown Motors – Back

(Mit freundlicher Genehmigung/Courtesy of Lordstown Motors Corp. [Media Page])

The disadvantage of this drive concept is the unsprung masses, which in the Endurance were approximately twice as high as in a comparable vehicle with a conventional powertrain due to the weight of the electric motor. In an interview, the founder and CEO Steve Burn explicitly confirmed that the development of the spring-damper system had been a major challenge [4].

After producing 31 vehicles, production was halted in February 2023 due to quality issues, with a well-known German car magazine already questioning the future of Lordstown Motors at that time [5].

The supplier for the electric motor was the Slovakian company Elaphe [6].

Sources

[1] https://www.carscoops.com/2019/12/lordstown-endurance-to-have-at-least-200-miles-of-range-and-four-electric-motors (Access 03.03.2023)

[2] https://investor.lordstownmotors.com/news-releases/news-release-details/foxconn-and-lordstown-motors-enter-transformative-strategic (Access, Zugriff 03.03.2023)

[3] https://investor.lordstownmotors.com/news-releases/news-release-details/lordstown-motors-and-foxconn-broaden-strategic-partnership (Access, Zugriff 03.03.2023)

[4] https://www.ideastream.org/news/economy/2020-06-29/lordstown-motors-big-gamble-on-hub-motors (Access 03.03.2023)

[5] https://www.auto-motor-und-sport.de/verkehr/hindenburg-research-lordstown-motors-iphone-hersteller-foxconn-werksverkauf (Access 03.03.2023)

[6] https://www.lordstownmotors.com/blogs/news/lordstown-motors-releases-business-updates-prepares-ohio-factory-to-begin-building-betas-next-month (Homepage, Access 03.03.2023)

[cs 03.03.2023, 06.08.2023, 13.12.205]

Lucid Motors was founded back in 2007 as a BEV start-up under a different name in California. Originally a supplier of BEV components such as battery and e-motor, it was renamed Lucid Motors in 2016. As part of this rebranding, the development of a luxury BEV vehicle was also announced, with the first prototype unveiled in December 2016. Welshman Peter Rawlinson, who was instrumental in the development of the Tesla Model S, joined Lucid as CTO in 2013 and became CEO in 2019 [1].

In a December 2022 equity offering, Lucid raised $1.5 billion, with $800 million coming from Saudi Arabian investors. In total, Saudi Arabian funds hold a stake of about 62%.

Lucid Motors follows the large-car-large-profit strategy, i.e. the first model Lucid Air is a luxury sedan with extreme performance data such more than 1000 hp, up to 883 km WLTP range and acceleration from 0 to 100 in 2.7 s. Lucid uses a 900 V architecture, which in particular also enables fast charging; a charging time of 15 min is specified for 400 km driving range [3].

In 2022, Lucid Motors has produced 7180 Air-type vehicles. Sales in Europe have also started, showrooms have been opened in Germany, Switzerland and the Netherlands, among other countries.

Lucid Motors achieved annual sales of $595.3 million in 2023; for 2024, the company reported sales of $807.8 million. In 2024, Lucid produced 9,029 vehicles and delivered a total of 10,241 vehicles. Delivery figures rose slightly in 2025, albeit from a low level; in the third quarter of 2025, the company delivered 4,078 vehicles.

Lucid Air – Exterieur

(Mit freundlicher Genehmigung/Courtesy of Lucid Group, Inc. [Media Room])

Lucid Air – Interieur

(Mit freundlicher Genehmigung/Courtesy of Lucid Group, Inc. [Media Room])

Due to the still very low number of units sold, Lucid continues to operate at a loss. In the third quarter of 2025, the net loss amounted to $978.4 million, which represents a slight decrease compared to the same period last year.

The Lucid Gravity is an SUV and Lucid Motors’ second model; series production began in Arizona at the end of 2024. According to industry figures, only nine Gravity SUVs were officially registered between January and June 2025, but Lucid says this does not reflect actual sales figures; the company itself claims to have sold several hundred units. The Gravity made its official debut in Europe at the IAA Mobility 2025 in Munich.

Delivery figures for Europe have been very low so far: according to reports, only 20 vehicles were newly registered in Germany in 2024, for example, and delivery figures across Europe were apparently in the low three-digit range.

Despite its high-quality drive and battery technology, Lucid faces major challenges in its transition from a niche manufacturer to higher production volumes. Although investor support secures financing in the short term, the company’s economic viability remains heavily dependent on whether Lucid can achieve significantly higher volumes at competitive costs in the medium term.

Lucent’s cell supplier is Panasonic [5].

Lucent is listed on the stock exchange, including in Frankfurt (ISIN US5494981039, WKN A3CVXG).

Sources

[1] https://www.businessinsider.de/wirtschaft/mobility/elon-musk-tesla-erfolgsgeheimnis-lucid-motors-air-chef-peter-rawlinson-unermuedlicher-optimismus (Access 04.03.2023)

[2] https://www.cnbc.com/2022/12/19/ev-maker-lucid-raises-from-the-saudi-public-wealth-fund-and-other-investors.html (Access 04.03.2023)

[3] https://www.lucidmotors.com/ (Homepage, Access 04.03.2023)

[4] https://www.lucidmotors.com/de-de/media-room/panasonic-agreement-supply-lithium-ion-batteries (Homepage, Access 04.03.2023)

[cs 04.03.2022, 13.12.2025]

Mullen Technologies [↑] [↓] [⇑] [⇓]

Mullen Technologies is a BEV start-up from California founded in 2012 by David Michery. It was difficult to identify a consistent corporate strategy in the company as it was originally founded. The models presented on the homepage were a hodgepodge of different vehicle categories such as sports cars, light trucks, trucks, vans, and SUVs [1].

As part of its strategic realignment, Mullen was merged with Bollinger Motors. The company now operates under the name Bollinger and focuses primarily on electric trucks for commercial use [2].

In the commercial vehicle sector, Bollinger focuses on battery-electric trucks in classes 1 to 5 for commercial use. The central model is the Bollinger B4, a fully electric Class 4 truck with a cab-over design, which belongs to the weight class of around 6.4 to 7.3 tons gross vehicle weight. The vehicle is designed for various commercial applications such as urban logistics, municipal fleets, and service vehicles, and is prepared for different body types.

In addition, the Bollinger B5 is a Class 5 truck that offers a higher payload with a gross vehicle weight of around 7.3 to 8.8 tons. The B5 is based on the same technical concept, but is aimed at more demanding applications in regional distribution transport as well as in the infrastructure and utilities sectors.

Actual sales figures for Bollinger trucks have remained limited to date. Although pre-orders and pilot projects with fleet customers have been announced, series deliveries are significantly below the originally announced expectations. Financial difficulties, production delays, and repeated restructuring have slowed the market ramp-up. Whether the truck activities can be established economically depends largely on stable demand and reliable series production.

Sources

[1] https://www.mullenusa.com/ (Access 09.03.2023)

[2] https://bollingerev.com/ (Zugriff 14.12.2025)

[cs 09.03.2023, 14.12.2025]

Munro Vehicles [↑] [↓] [⇑] [⇓]

Munro Vehicles is a Scottish BEV start-up founded in 2021 by Russ Peterson and Ross Anderson. The company specializes in electric all-wheel-drive vehicles and develops robust electric 4×4 vehicles for demanding working environments such as mining, rescue, defense, and off-road applications.

Munro Vehicles has positioned itself particularly well with its Series-M production model; the model range includes variants such as the M170 and the more powerful M280, which differ technically in terms of power, torque, and price, but are all based on robust LFP battery technology.

No detailed, officially confirmed sales figures are available for 2023, although Munro reported several pre-orders and initial series production. Only a few concrete deliveries are reported for 2024; according to the company, four vehicles were sold in 2024, with the order backlog growing steadily to reach a volume of around £17 million (over 240 vehicles) by mid-2025.

Complete year-end figures for 2025 are not yet available, but the growing order book indicates rising demand; specific delivery figures for 2025 have not yet been officially reported.

Munro Vehicles

(Mit freundlicher Genehmigung/Courtesy of ALL TERRAIN ALL ELECTRIC LTD [Homepage])

Official, audited financial figures such as revenue or profit/loss for 2024 and 2025 are not publicly available. The company received fresh capital of around £2 million in October 2025 to scale up production of the Series M and meet existing demand, indicating the need for further financing to expand production.

Munro Vehicles uses robust LFP cells, although the cell manufacturer is unknown.

Sources

[1] https://www.munro-ev.com/ (Access 14.12.2025)

[cs 10.03.2023, 14.12.2025]

NIO is a BEV start-up founded by William Li in Shanghai in 2014; investors include Baidu, Lenovo and Tencent. The product range includes SUVs and sedans; since October 2022, some of the vehicles have also been exported to Europe. From 2018 to 2022, NIO was able to increase its sales by ~8,000 to ~122,000 cars [1].

In 2024, the company achieved a new record year with 221,970 vehicles delivered (+38.7% compared to 2023). Cumulative total deliveries at the end of 2024 amounted to around 671,564 vehicles.

The upward trend initially continued in 2025: 42,094 vehicles were delivered in the first quarter (+over 40% compared to Q1 2024) and 72,056 vehicles in the second quarter (+25.6% compared to the previous year). For 2025 as a whole, NIO expects sales of between 400,000 and 450,000 vehicles, depending on the source. This would mean that the company would almost double its sales compared to 2024, but would still lag behind its major competitors Tesla and BYD.

In addition to Germany, its European target markets include the Netherlands, Denmark, Norway, and Sweden (as already established core markets). NIO also plans to expand its presence in Europe.

In addition, NIO has introduced two sub–brands: ONVO (formerly Alps) for the mid-price segment and Firefly (for the entry-level segment). The ONVO brand was launched in China in mid-2024, while Firefly will be launched in China in early 2025. Both brands are set to enter the European market in 2025 and will target a broader customer base in China and Europe in particular. The aim is to use the new brands to compete more directly with volume manufacturers such as Volkswagen, Toyota, and BYD.

Despite rising sales figures and growing revenues, NIO is not yet profitable and is expected to continue to report significant losses in the years 2023 to 2025:

- In 2023, NIO generated revenues of around RMB 55.6 billion (≈ €7.1 billion), with a net loss of around RMB 22.0 billion (≈ €2.8 billion), which is primarily attributable to intense price competition in the Chinese market.

- Revenue growth continued in 2024, rising to around RMB 65.7 billion (≈ €8.4 billion). Nevertheless, losses could not be reduced, amounting to

RMB 22.7 billion (≈ €2.8 billion). - For 2025, the quarterly figures point to an improvement in operations, but the company remains in the red. In the third quarter of 2025, NIO reported a net loss of around RMB 3.5 billion (≈ €0.48 billion). A negative annual result is therefore to be expected for 2025.

NIO ET7

(Mit freundlicher Genehmigung/Courtesy NIO Deutschlang GmbH [Press Release])

Battery swapping station from NIO

(Mit freundlicher Genehmigung/Courtesy of NIO Deutschlang GmbH [Press Release])

One of the special features of NIO is the battery exchange concept, with which NIO currently has a unique selling point. In special exchange stations, empty batteries can be replaced by full batteries, with the exchange taking place fully automatically and in just 5 minutes.

NIO now operates over 3,500 battery swap stations in China, more than 1,000 of which are located along highways. These stations perform up to 100,000 battery swaps every day. The battery swap system (“Power Swap Station”) is considered a central component of NIO’s infrastructure strategy and is set to be expanded further.

Exchange stations are now also in operation in Germany, with EnBW coming on board as a cooperation partner. Of course, vehicles with exchange batteries can also be charged at normal charging stations, i.e. battery exchange is an additional charging option.

In addition to saving time, battery replacement offers other advantages:

- Battery capacity loss is no longer an issue for vehicle buyers.

- Battery capacity can be adapted to the required driving profile.

- Older, already manufactured vehicles can also benefit from technological advances in cell technology.

Nevertheless, it remains to be seen whether the “battery swap” concept can hold its own against classic, cable-based charging in the long term.

Currently, there is a great deal of research being conducted on fast charging, and investments are being made in the expansion of fast DC chargers, i.e. the time saved by replacing the battery will be reduced. In addition, the construction of the exchange stations involves costs that NIO will have to bear on its own.

The main supplier of battery cells for NIO is CATL, with whom the company has a strategic partnership for the further development of battery technologies and the expansion of the battery exchange network.

For its particularly high-energy 150 kWh battery packs, cells from specialist supplier WeLion were sourced using semi-solid-state technology; However, production of the 150 kWh pack was discontinued in 2025 after only a few hundred units due to low demand. Nevertheless, this example impressively demonstrates the potential of the battery replacement concept.

In addition, NIO is diversifying its cell procurement through other suppliers such as CALB and Sunwoda, the latter primarily for the Firefly sub-brand.

NIO is listed on the stock exchange, among others in Frankfurt (ISIN US62914V1061, WKN WKN A2N4PB).

Sources

[1] https://www.nio.com/de_DE (Homepage, Access 17.03.2023)

[cs 17.03.2023, 11.7.2024, 16.12.2025]

Olymp Cars was a BEV start-up from Austria that was founded as a joint project between the companies abo-drive and Modern Mobility GmbH, both of which operate in the fleet management sector [1].